Page 8 - UFSTSG Professional Package Ownership Short_final

P. 8

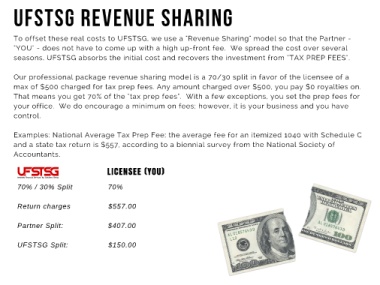

UFSTSG REVENUE SHARING

To offset these real costs to UFSTSG, we use a "Revenue Sharing" model so that the Partner -

"YOU" - does not have to come up with a high up-front fee. We spread the cost over several

seasons. UFSTSG absorbs the initial cost and recovers the investment from "TAX PREP FEES".

Our professional package revenue sharing model is a 70/30 split in favor of the licensee of a

max of $500 charged for tax prep fees. Any amount charged over $500, you pay $0 royalties on.

That means you get 70% of the "tax prep fees". With a few exceptions, you set the prep fees for

your office. We do encourage a minimum on fees; however, it is your business and you have

control.

Examples: National Average Tax Prep Fee: the average fee for an itemized 1040 with Schedule C

and a state tax return is $557, according to a biennial survey from the National Society of

Accountants.

LICENSEE (YOU)

70% / 30% Split 70%

Return charges $557.00

Partner Split: $407.00

UFSTSG Split: $150.00