Page 9 - tmp

P. 9

TAX YEAR

2019

Business Entity

Comparison Chart

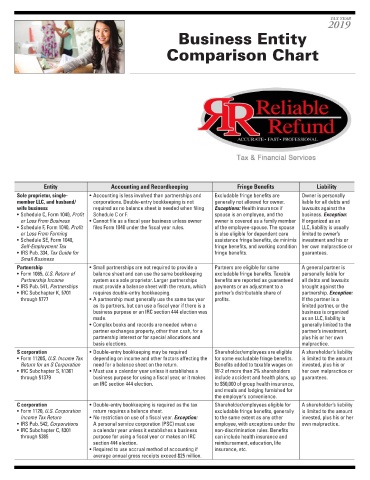

Entity Accounting and Recordkeeping Fringe Benefits Liability

Sole proprietor, single- • Accounting is less involved than partnerships and Excludable fringe benefits are Owner is personally

member LLC, and husband/ corporations. Double-entry bookkeeping is not generally not allowed for owner. liable for all debts and

wife business required as no balance sheet is needed when filing Exceptions: Health insurance if lawsuits against the

• Schedule C, Form 1040, Profit Schedule C or F. spouse is an employee, and the business. Exception:

or Loss From Business • Cannot file as a fiscal year business unless owner owner is covered as a family member If organized as an

• Schedule F, Form 1040, Profit files Form 1040 under the fiscal year rules. of the employee-spouse. The spouse LLC, liability is usually

or Loss From Farming is also eligible for dependent care limited to owner’s

• Schedule SE, Form 1040, assistance fringe benefits, de minimis investment and his or

Self-Employment Tax fringe benefits, and working condition her own malpractice or

• IRS Pub. 334, Tax Guide for fringe benefits. guarantees.

Small Business

Partnership • Small partnerships are not required to provide a Partners are eligible for some A general partner is

• Form 1065, U.S. Return of balance sheet and can use the same bookkeeping excludable fringe benefits. Taxable personally liable for

Partnership Income system as a sole proprietor. Larger partnerships benefits are reported as guaranteed all debts and lawsuits

• IRS Pub. 541, Partnerships must provide a balance sheet with the return, which payments or an adjustment to a brought against the

• IRC Subchapter K, §701 requires double-entry bookkeeping. partner’s distributable share of partnership. Exception:

through §777 • A partnership must generally use the same tax year profits. If the partner is a

as its partners, but can use a fiscal year if there is a limited partner, or the

business purpose or an IRC section 444 election was business is organized

made. as an LLC, liability is

• Complex books and records are needed when a generally limited to the

partner exchanges property, other than cash, for a partner’s investment,

partnership interest or for special allocations and plus his or her own

basis elections. malpractice.

S corporation • Double-entry bookkeeping may be required Shareholder/employees are eligible A shareholder’s liability

• Form 1120S, U.S. Income Tax depending on income and other factors affecting the for some excludable fringe benefits. is limited to the amount

Return for an S Corporation need for a balance sheet on the return. Benefits added to taxable wages on invested, plus his or

• IRC Subchapter S, §1361 • Must use a calendar year unless it establishes a W-2 of more than 2% shareholders her own malpractice or

through §1379 business purpose for using a fiscal year, or it makes include accident and health plans, up guarantees.

an IRC section 444 election. to $50,000 of group health insurance,

and meals and lodging furnished for

the employer’s convenience.

C corporation • Double-entry bookkeeping is required as the tax Shareholder/employees eligible for A shareholder’s liability

• Form 1120, U.S. Corporation return requires a balance sheet. excludable fringe benefits, generally is limited to the amount

Income Tax Return • No restriction on use of a fiscal year. Exception: to the same extent as any other invested, plus his or her

• IRS Pub. 542, Corporations A personal service corporation (PSC) must use employee, with exceptions under the own malpractice.

• IRC Subchapter C, §301 a calendar year unless it establishes a business non-discrimination rules. Benefits

through §385 purpose for using a fiscal year or makes an IRC can include health insurance and

section 444 election. reimbursement, education, life

• Required to use accrual method of accounting if insurance, etc.

average annual gross receipts exceed $25 million.