Page 15 - RR virtual office

P. 15

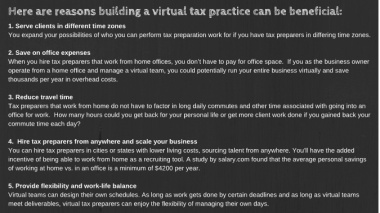

Here are reasons building a virtual tax practice can be beneficial:

1. Serve clients in different time zones

You expand your possibilities of who you can perform tax preparation work for if you have tax preparers in differing time zones.

2. Save on office expenses

When you hire tax preparers that work from home offices, you don’t have to pay for office space. If you as the business owner

operate from a home office and manage a virtual team, you could potentially run your entire business virtually and save

thousands per year in overhead costs.

3. Reduce travel time

Tax preparers that work from home do not have to factor in long daily commutes and other time associated with going into an

office for work. How many hours could you get back for your personal life or get more client work done if you gained back your

commute time each day?

4. Hire tax preparers from anywhere and scale your business

You can hire tax preparers in cities or states with lower living costs, sourcing talent from anywhere. You’ll have the added

incentive of being able to work from home as a recruiting tool. A study by salary.com found that the average personal savings

of working at home vs. in an office is a minimum of $4200 per year.

5. Provide flexibility and work-life balance

Virtual teams can design their own schedules. As long as work gets done by certain deadlines and as long as virtual teams

meet deliverables, virtual tax preparers can enjoy the flexibility of managing their own days.