Page 129 - Aug 2019 BOG Book_Neat

P. 129

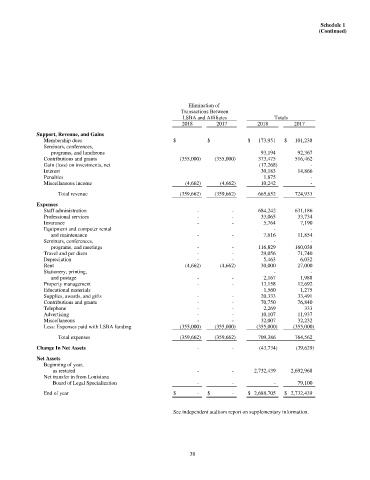

Schedule 1

(Continued)

Elimination of

Transactions Between

LSBA and Affiliates Totals

2018 2017 2018 2017

Support, Revenue, and Gains

Membership dues $ $ $ 173,951 $ 101,238

Seminars, conferences,

programs, and luncheons 93,194 92,367

Contributions and grants (355,000) (355,000) 373,475 516,462

Gain (loss) on investments, net (17,268) -

Interest 30,183 14,866

Penalties 1,875 -

Miscellaneous income (4,662) (4,662) 10,242 -

Total revenue (359,662) (359,662) 665,652 724,933

Expenses

Staff administration - - 684,242 631,186

Professional services - - 33,065 33,734

Insurance - - 5,764 7,190

Equipment and computer rental - -

and maintenance - - 7,616 11,854

Seminars, conferences, - -

programs, and meetings - - 116,829 160,038

Travel and per diem - - 29,056 71,740

Depreciation - - 5,463 6,032

Rent (4,662) (4,662) 30,000 27,000

Stationery, printing, - -

and postage - - 2,167 1,988

Property management - - 13,158 12,692

Educational materials 1,560 1,275

Supplies, awards, and gifts - - 20,333 33,491

Contributions and grants - - 70,750 76,840

Telephone - - 2,269 333

Advertising - - 10,107 11,937

Miscellaneous - - 32,007 32,232

Less: Expenses paid with LSBA funding (355,000) (355,000) (355,000) (355,000)

Total expenses (359,662) (359,662) 709,386 764,562

Change In Net Assets - - (43,734) (39,629)

Net Assets

Beginning of year,

as restated - - 2,732,439 2,692,968

Net transfer in from Louisiana

Board of Legal Specialization - - - 79,100

End of year $ - $ - $ 2,688,705 $ 2,732,439

See independent auditors report on supplementary information.

38