Page 7 - 11639_2019 Open EnrollmentGuidebook_interactive

P. 7

ENROLLMENT AND ELIGIBIXLIXTXY

Have a Life Event?

If you experience one of the Life Events listed below, you must go online to JUMP! Benefits within 30 days of the event to make changes to your benefits. Any changes you make to your benefit elections must be consistent with the Life Event.

For example, adding a dependent to your medical and dental coverage would be consistent with the birth or adoption of a child. Adding coverage for your spouse because his or her insurance contributions increased would not be considered a life event or relevant benefit change.

Here’s what you need to do:

• Go online to JUMP! Benefits within 30 calendar days of the event

• Make any relevant changes to your benefit elections within the 30-day window of the qualifying life event

• Upload required documentation for any life event directly to JUMP! Benefits. Your changes will not be finalized until the appropriate life event documentation and / or dependent verification has been reviewed and approved by Human Resources.

IMPORTANT: If you miss the 30-day window, Federal regulations require that you wait until the next open enrollment period to make changes that will be effective the beginning of the next plan year.

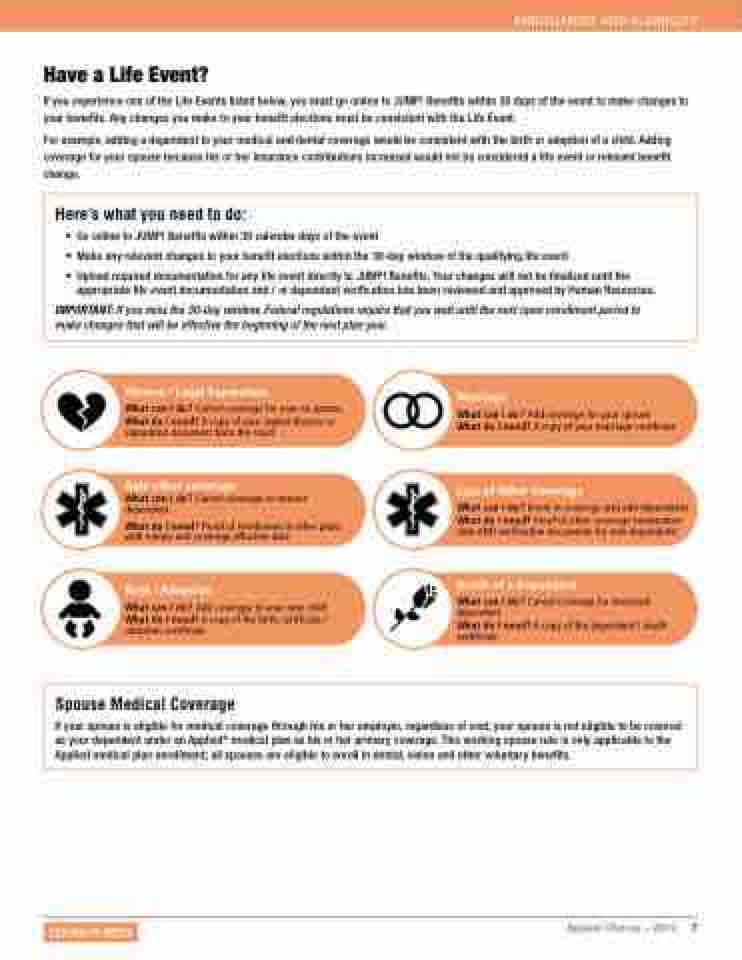

Divorce / Legal Separation

What can I do? Cancel coverage for your ex spouse What do I need? A copy of your signed divorce or separation document from the court

Gain other coverage

What can I do? Cancel coverage or remove dependent

What do I need? Proof of enrollment in other plans with names and coverage effective date

Birth / Adoption

What can I do? Add coverage to your new child What do I need? A copy of the birth certificate / adoption certificate

Marriage

What can I do? Add coverage for your spouse What do I need? A copy of your marriage certificate

Loss of Other Coverage

What can I do? Enroll in coverage and add dependents What do I need? Proof of other coverage termination date AND verification documents for new dependents

Death of a Dependent

What can I do? Cancel coverage for deceased dependent

What do I need? A copy of the dependent’s death certificate

Spouse Medical Coverage

If your spouse is eligible for medical coverage through his or her employer, regardless of cost, your spouse is not eligible to be covered as your dependent under an Applied® medical plan as his or her primary coverage. This working spouse rule is only applicable to the Applied medical plan enrollment; all spouses are eligible to enroll in dental, vision and other voluntary benefits.

RETURN TO INDEX

Applied Choices – 2019 7