Page 352 - Department of Social Development Annual Report 2021

P. 352

PART E: FINANCIAL INFORMATION

SOCIAL RELIEF FUND

Notes To The Financial Statements Of The Social Relief Fund For The Year Ended

31 March 2021.

7. Risk Management

7.1.1 Market Risk

Market risk is the risk that changes in market prices. Interest rates will affect the Social Relief Fund. The objective of

market risk management is to manage and control market risk exposure within acceptable parameters while optimizing

return. The Social Relief Fund does not manage this risk aggressively as the investments of funds are determined by the

Minister of Social Development and the Minister of Finance. Within these parameters, funds are invested with reputable

financial institutions.

7.1.2 Credit Risk

Credit risk is the risk of financial loss to the Social Relief Fund if a financial institution to a financial instrument fails to

meet its contractual obligations.

The Social Relief Fund exposure to credit risk is influenced only by the individual characteristics of the financial

institutions where funds are deposited or invested. Reputable financial institutions are used for investing and cash

handling purposes.

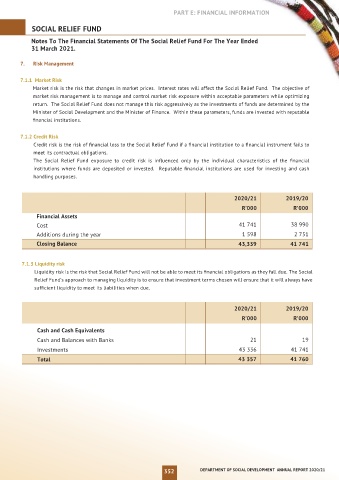

2020/21 2019/20

R’000 R’000

Financial Assets

Cost 41 741 38 990

Additions during the year 1 598 2 751

Closing Balance 43,339 41 741

7.1.3 Liquidity risk

Liquidity risk is the risk that Social Relief Fund will not be able to meet its financial obligations as they fall due. The Social

Relief Fund’s approach to managing liquidity is to ensure that investment terms chosen will ensure that it will always have

sufficient liquidity to meet its liabilities when due.

2020/21 2019/20

R’000 R’000

Cash and Cash Equivalents

Cash and Balances with Banks 21 19

Investments 43 336 41 741

Total 43 357 41 760

352 DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2020/21