Page 6 - March Market Update digital

P. 6

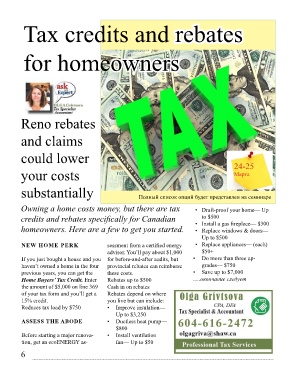

Tax credits and rebates

for homeowners

Reno rebates

and claims

could lower 24-25

your costs Марта

substantially Полный список опций будет представлен на семинаре

Owning a home costs money, but there are tax • Draft-proof your home— Up

credits and rebates specifically for Canadian • to $500

Install a gas fireplace— $300

homeowners. Here are a few to get you started. • Replace windows & doors—

Up to $500

NEW HOME PERK sessment from a certified energy • Replace appliances— (each)

advisor. You’ll pay about $1,000 $50+

If you just bought a house and you for before-and-after audits, but • Do more than three up-

haven’t owned a home in the four provincial rebates can reimburse grades— $750

previous years, you can get the these costs. • Save up to $7,000

Home Buyers’ Tax Credit. Enter Rebates up to $500 .....окончание следует

the amount of $5,000 on line 369 Cash in on rebates

of your tax form and you’ll get a Rebates depend on where

15% credit. you live but can include:

Reduces tax load by $750 • Improve insulation—

Up to $3,250

ASSESS THE ABODE • Ductless heat pump—

$800

Before starting a major renova- • Install ventilation

tion, get an ecoENERGY as- fan— Up to $50

6