Page 8 - Rauxa EE Guide 04-19 CA

P. 8

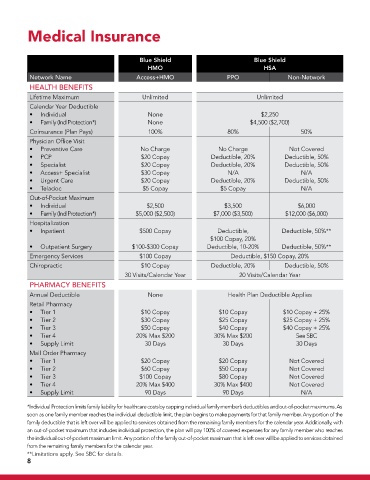

Medical Insurance

Blue Shield Blue Shield

HMO HSA

Network Name Access+HMO PPO Non-Network

HEALTH BENEFITS

Lifetime Maximum Unlimited Unlimited

Calendar Year Deductible

• Individual None $2,250

• Family (Ind Protection*) None $4,500 ($2,700)

Coinsurance (Plan Pays) 100% 80% 50%

Physician Office Visit

• Preventive Care No Charge No Charge Not Covered

• PCP $20 Copay Deductible, 20% Deductible, 50%

• Specialist $20 Copay Deductible, 20% Deductible, 50%

• Access+ Specialist $30 Copay N/A N/A

• Urgent Care $20 Copay Deductible, 20% Deductible, 50%

• Teladoc $5 Copay $5 Copay N/A

Out-of-Pocket Maximum

• Individual $2,500 $3,500 $6,000

• Family (Ind Protection*) $5,000 ($2,500) $7,000 ($3,500) $12,000 ($6,000)

Hospitalization

• Inpatient $500 Copay Deductible, Deductible, 50%**

$100 Copay, 20%

• Outpatient Surgery $100-$300 Copay Deductible, 10-20% Deductible, 50%**

Emergency Services $100 Copay Deductible, $150 Copay, 20%

Chiropractic $10 Copay Deductible, 20% Deductible, 50%

30 Visits/Calendar Year 20 Visits/Calendar Year

PHARMACY BENEFITS

Annual Deductible None Health Plan Deductible Applies

Retail Pharmacy

• Tier 1 $10 Copay $10 Copay $10 Copay + 25%

• Tier 2 $30 Copay $25 Copay $25 Copay + 25%

• Tier 3 $50 Copay $40 Copay $40 Copay + 25%

• Tier 4 20% Max $200 30% Max $200 See SBC

• Supply Limit 30 Days 30 Days 30 Days

Mail Order Pharmacy

• Tier 1 $20 Copay $20 Copay Not Covered

• Tier 2 $60 Copay $50 Copay Not Covered

• Tier 3 $100 Copay $80 Copay Not Covered

• Tier 4 20% Max $400 30% Max $400 Not Covered

• Supply Limit 90 Days 90 Days N/A

*Individual Protection limits family liability for healthcare costs by capping individual family member’s deductibles and out-of-pocket maximums. As

soon as one family member reaches the individual deductible limit, the plan begins to make payments for that family member. Any portion of the

family deductible that is left over will be applied to services obtained from the remaining family members for the calendar year. Additionally, with

an out-of-pocket maximum that includes individual protection, the plan will pay 100% of covered expenses for any family member who reaches

the individual out-of-pocket maximum limit. Any portion of the family out-of-pocket maximum that is left over will be applied to services obtained

from the remaining family members for the calendar year.

**Limitations apply. See SBC for details.

8