Page 7 - United Capital EE PFE Guide 2019-2020

P. 7

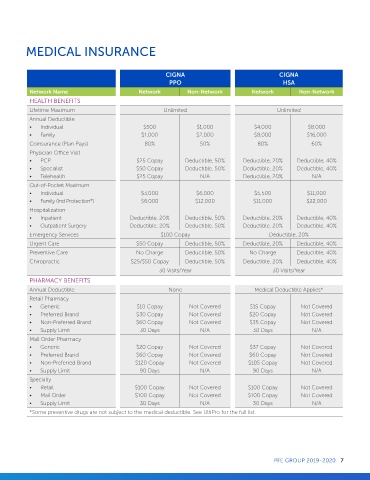

MEDICAL INSURANCE

CIGNA CIGNA

PPO HSA

Network Name Network Non-Network Network Non-Network

HEALTH BENEFITS

Lifetime Maximum Unlimited Unlimited

Annual Deductible

• Individual $500 $1,000 $4,000 $8,000

• Family $1,000 $2,000 $8,000 $16,000

Coinsurance (Plan Pays) 80% 50% 80% 60%

Physician Office Visit

• PCP $25 Copay Deductible, 50% Deductible, 20% Deductible, 40%

• Specialist $50 Copay Deductible, 50% Deductible, 20% Deductible, 40%

• Telehealth $25 Copay N/A Deductible, 20% N/A

Out-of-Pocket Maximum

• Individual $3,000 $6,000 $5,500 $11,000

• Family (Ind Protection*) $6,000 $12,000 $11,000 $22,000

Hospitalization

• Inpatient Deductible, 20% Deductible, 50% Deductible, 20% Deductible, 40%

• Outpatient Surgery Deductible, 20% Deductible, 50% Deductible, 20% Deductible, 40%

Emergency Services $100 Copay Deductible, 20%

Urgent Care $50 Copay Deductible, 50% Deductible, 20% Deductible, 40%

Preventive Care No Charge Deductible, 50% No Charge Deductible, 40%

Chiropractic $25/$50 Copay Deductible, 50% Deductible, 20% Deductible, 40%

30 Visits/Year 30 Visits/Year

PHARMACY BENEFITS

Annual Deductible None Medical Deductible Applies*

Retail Pharmacy

• Generic $10 Copay Not Covered $15 Copay Not Covered

• Preferred Brand $30 Copay Not Covered $20 Copay Not Covered

• Non-Preferred Brand $60 Copay Not Covered $35 Copay Not Covered

• Supply Limit 30 Days N/A 30 Days N/A

Mail Order Pharmacy

• Generic $20 Copay Not Covered $37 Copay Not Covered

• Preferred Brand $60 Copay Not Covered $60 Copay Not Covered

• Non-Preferred Brand $120 Copay Not Covered $105 Copay Not Covered

• Supply Limit 90 Days N/A 90 Days N/A

Specialty

• Retail $100 Copay Not Covered $100 Copay Not Covered

• Mail Order $100 Copay Not Covered $100 Copay Not Covered

• Supply Limit 30 Days N/A 30 Days N/A

*Some preventive drugs are not subject to the medical deductible. See UltiPro for the full list.

PFE GROUP 2019-2020 7