Page 12 - HM Benefits Guide 2019 CA

P. 12

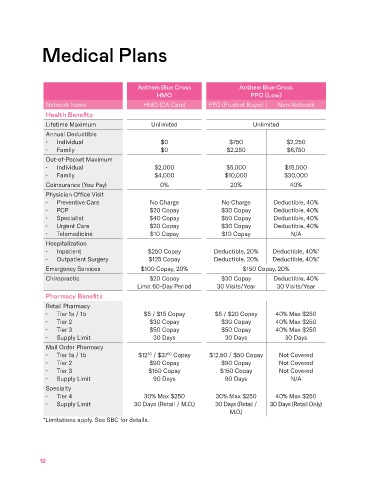

Medical Plans

Anthem Blue Cross Anthem Blue Cross

HMO PPO (Low)

Network Name HMO (CA Care) PPO (Prudent Buyer) Non-Network

Health Benefits

Lifetime Maximum Unlimited Unlimited

Annual Deductible

• Individual $0 $750 $2,250

• Family $0 $2,250 $6,750

Out-of-Pocket Maximum

• Individual $2,000 $5,000 $15,000

• Family $4,000 $10,000 $30,000

Coinsurance (You Pay) 0% 20% 40%

Physician Office Visit

• Preventive Care No Charge No Charge Deductible, 40%

• PCP $20 Copay $30 Copay Deductible, 40%

• Specialist $40 Copay $50 Copay Deductible, 40%

• Urgent Care $20 Copay $30 Copay Deductible, 40%

• Telemedicine $10 Copay $10 Copay N/A

Hospitalization

• Inpatient $250 Copay Deductible, 20% Deductible, 40%*

• Outpatient Surgery $125 Copay Deductible, 20% Deductible, 40%*

Emergency Services $100 Copay, 20% $150 Copay, 20%

Chiropractic $20 Copay $30 Copay Deductible, 40%

Limit 60-Day Period 30 Visits/Year 30 Visits/Year

Pharmacy Benefits

Retail Pharmacy

• Tier 1a / 1b $5 / $15 Copay $5 / $20 Copay 40% Max $250

• Tier 2 $30 Copay $30 Copay 40% Max $250

• Tier 3 $50 Copay $50 Copay 40% Max $250

• Supply Limit 30 Days 30 Days 30 Days

Mail Order Pharmacy

50

• Tier 1a / 1b $12 / $37 Copay $12.50 / $50 Copay Not Covered

50

• Tier 2 $90 Copay $90 Copay Not Covered

• Tier 3 $150 Copay $150 Copay Not Covered

• Supply Limit 90 Days 90 Days N/A

Specialty

• Tier 4 30% Max $250 30% Max $250 40% Max $250

• Supply Limit 30 Days (Retail / M.O.) 30 Days (Retail / 30 Days (Retail Only)

M.O.)

*Limitations apply. See SBC for details.

12