Page 12 - Column Five EE Guide 12-19 -California

P. 12

BENEFITS

Disability Insurance Retirement Planning

If you are unable to work due to an illness or injury, Guideline | 401(k) Safe Harbor Plan

disability provides a source of income to meet your You are encouraged to participate in Column Five Media’s 401(k)

needs. Disability insurance provides benefits that plan. This plan allows you to fund your retirement with pre-tax

replace part of your lost income when you become dollars. If you are 50 years old or older during the plan year, you may

unable to work due to a covered injury or illness. contribute a catch-up deferral.

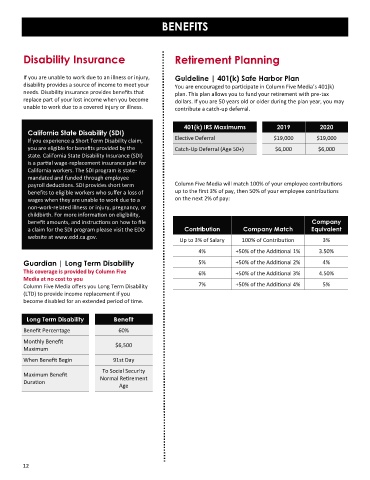

401(k) IRS Maximums 2019 2020

California State Disability (SDI)

If you experience a Short Term Disability claim, Elective Deferral $19,000 $19,000

you are eligible for benefits provided by the Catch-Up Deferral (Age 50+) $6,000 $6,000

state. California State Disability Insurance (SDI)

is a partial wage-replacement insurance plan for

California workers. The SDI program is state-

mandated and funded through employee

payroll deductions. SDI provides short term Column Five Media will match 100% of your employee contributions

benefits to eligible workers who suffer a loss of up to the first 3% of pay, then 50% of your employee contributions

wages when they are unable to work due to a on the next 2% of pay:

non-work-related illness or injury, pregnancy, or

childbirth. For more information on eligibility,

benefit amounts, and instructions on how to file Company

a claim for the SDI program please visit the EDD Contribution Company Match Equivalent

website at www.edd.ca.gov.

Up to 3% of Salary 100% of Contribution 3%

4% +50% of the Additional 1% 3.50%

Guardian | Long Term Disability 5% +50% of the Additional 2% 4%

This coverage is provided by Column Five 6% +50% of the Additional 3% 4.50%

Media at no cost to you

Column Five Media offers you Long Term Disability 7% +50% of the Additional 4% 5%

(LTD) to provide income replacement if you

become disabled for an extended period of time.

Long Term Disability Benefit

Benefit Percentage 60%

Monthly Benefit $6,500

Maximum

When Benefit Begin 91st Day

To Social Security

Maximum Benefit

Normal Retirement

Duration

Age

12