Page 17 - Ria Benefits Guide 2020 FINAL CO

P. 17

Income Protection

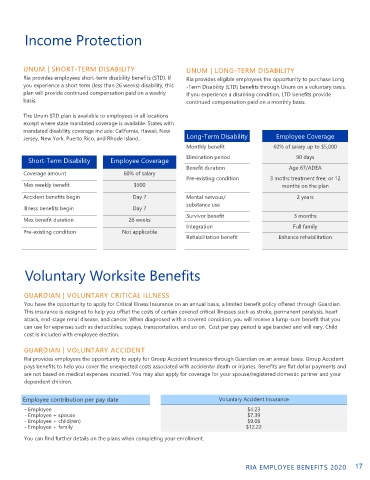

UNUM | SHORT-TERM DISABILITY UNUM | LONG-TERM DISABILITY

Ria provides employees short-term disability benefits (STD). If Ria provides eligible employees the opportunity to purchase Long

you experience a short term (less than 26 weeks) disability, this -Term Disability (LTD) benefits through Unum on a voluntary basis.

plan will provide continued compensation paid on a weekly If you experience a disabling condition, LTD benefits provide

basis. continued compensation paid on a monthly basis.

The Unum STD plan is available to employees in all locations

except where state mandated coverage is available. States with

mandated disability coverage include: California, Hawaii, New

Jersey, New York, Puerto Rico, and Rhode Island.. Long-Term Disability Employee Coverage

Monthly benefit 60% of salary up to $5,000

Short-Term Disability Employee Coverage Elimination period 90 days

Benefit duration Age 67/ADEA

Coverage amount 60% of salary

Pre-existing condition 3 moths treatment free; or 12

Max weekly benefit $500 months on the plan

Accident benefits begin Day 7 Mental nervous/ 2 years

substance use

Illness benefits begin Day 7

Survivor benefit 3 months

Max benefit duration 26 weeks

Integration Full family

Pre-existing condition Not applicable

Rehabilitation benefit Enhance rehabilitation

Voluntary Worksite Benefits

GUARDIAN | VOLUNTARY CRITICAL ILLNESS

You have the opportunity to apply for Critical Illness Insurance on an annual basis, a limited benefit policy offered through Guardian.

This insurance is designed to help you offset the costs of certain covered critical illnesses such as stroke, permanent paralysis, heart

attack, end-stage renal disease, and cancer. When diagnosed with a covered condition, you will receive a lump-sum benefit that you

can use for expenses such as deductibles, copays, transportation, and so on. Cost per pay period is age banded and will vary. Child

cost is included with employee election.

GUARDIAN | VOLUNTARY ACCIDENT

Ria provides employees the opportunity to apply for Group Accident Insurance through Guardian on an annual basis. Group Accident

pays benefits to help you cover the unexpected costs associated with accidental death or injuries. Benefits are flat dollar payments and

are not based on medical expenses incurred. You may also apply for coverage for your spouse/registered domestic partner and your

dependent children.

Employee contribution per pay date Voluntary Accident Insurance

- Employee $4.23

- Employee + spouse $7.39

- Employee + child(ren) $9.06

- Employee + family $12.22

You can find further details on the plans when completing your enrollment.

RIA EMPLOYEE BENEFITS 2020 17