Page 12 - QSC EE Guide 01-20 CA

P. 12

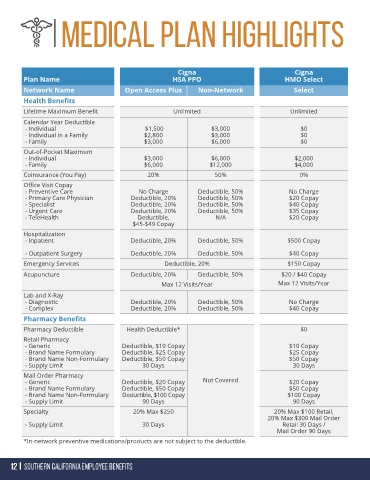

Cigna Cigna

Plan Name HSA PPO HMO Select

Network Name Open Access Plus Non-Network Select

Health Benefits

Lifetime Maximum Benefit Unlimited Unlimited

Calendar Year Deductible

- Individual $1,500 $3,000 $0

- Individual in a Family $2,800 $3,000 $0

- Family $3,000 $6,000 $0

Out-of-Pocket Maximum

- Individual $3,000 $6,000 $2,000

- Family $6,000 $12,000 $4,000

Coinsurance (You Pay) 20% 50% 0%

Office Visit Copay

- Preventive Care No Charge Deductible, 50% No Charge

- Primary Care Physician Deductible, 20% Deductible, 50% $20 Copay

- Specialist Deductible, 20% Deductible, 50% $40 Copay

- Urgent Care Deductible, 20% Deductible, 50% $35 Copay

- TeleHealth Deductible, N/A $20 Copay

$45-$49 Copay

Hospitalization

- Inpatient Deductible, 20% Deductible, 50% $500 Copay

- Outpatient Surgery Deductible, 20% Deductible, 50% $40 Copay

Emergency Services Deductible, 20% $150 Copay

Acupuncture Deductible, 20% Deductible, 50% $20 / $40 Copay

Max 12 Visits/Year Max 12 Visits/Year

Lab and X-Ray

- Diagnostic Deductible, 20% Deductible, 50% No Charge

- Complex Deductible, 20% Deductible, 50% $40 Copay

Pharmacy Benefits

Pharmacy Deductible Health Deductible* $0

Retail Pharmacy

- Generic Deductible, $10 Copay $10 Copay

- Brand Name Formulary Deductible, $25 Copay $25 Copay

- Brand Name Non-Formulary Deductible, $50 Copay $50 Copay

- Supply Limit 30 Days 30 Days

Mail Order Pharmacy

- Generic Deductible, $20 Copay Not Covered $20 Copay

- Brand Name Formulary Deductible, $50 Copay $50 Copay

- Brand Name Non-Formulary Deductible, $100 Copay $100 Copay

- Supply Limit 90 Days 90 Days

Specialty 20% Max $250 20% Max $100 Retail,

20% Max $300 Mail Order

- Supply Limit 30 Days Retail 30 Days /

Mail Order 90 Days

*In-network preventive medications/products are not subject to the deductible.