Page 7 - Murad Benefits Guide 2020 NonCA

P. 7

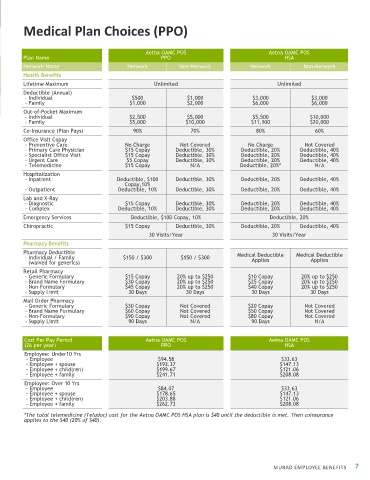

Medical Plan Choices (PPO)

Aetna OAMC POS Aetna OAMC POS

Plan Name PPO HSA

Network Name Network Non-Network Network Non-Network

Health Benefits

Lifetime Maximum Unlimited Unlimited

Deductible (Annual)

- Individual $500 $1,000 $3,000 $3,000

- Family $1,000 $2,000 $6,000 $6,000

Out-of-Pocket Maximum

- Individual $2,500 $5,000 $5,500 $10,000

- Family $5,000 $10,000 $11,100 $20,000

Co-Insurance (Plan Pays) 90% 70% 80% 60%

Office Visit Copay

- Preventive Care No Charge Not Covered No Charge Not Covered

- Primary Care Physician $15 Copay Deductible, 30% Deductible, 20% Deductible, 40%

- Specialist Office Visit $15 Copay Deductible, 30% Deductible, 20% Deductible, 40%

- Urgent Care $5 Copay Deductible, 30% Deductible, 20% Deductible, 40%

- Telemedicine $15 Copay N/A Deductible, 20%* N/A

Hospitalization

- Inpatient Deductible, $100 Deductible, 30% Deductible, 20% Deductible, 40%

Copay,10%

- Outpatient Deductible, 10% Deductible, 30% Deductible, 20% Deductible, 40%

Lab and X-Ray

- Diagnostic $15 Copay Deductible, 30% Deductible, 20% Deductible, 40%

- Complex Deductible, 10% Deductible, 30% Deductible, 20% Deductible, 40%

Emergency Services Deductible, $100 Copay, 10% Deductible, 20%

Chiropractic $15 Copay Deductible, 30% Deductible, 20% Deductible, 40%

30 Visits/Year 30 Visits/Year

Pharmacy Benefits

Pharmacy Deductible Medical Deductible Medical Deductible

- Individual / Family $150 / $300 $150 / $300 Applies Applies

(waived for generics)

Retail Pharmacy

- Generic Formulary $15 Copay 20% up to $250 $10 Copay 20% up to $250

- Brand Name Formulary $30 Copay 20% up to $250 $25 Copay 20% up to $250

- Non-Formulary $45 Copay 20% up to $250 $40 Copay 20% up to $250

- Supply Limit 30 Days 30 Days 30 Days 30 Days

Mail Order Pharmacy

- Generic Formulary $30 Copay Not Covered $20 Copay Not Covered

- Brand Name Formulary $60 Copay Not Covered $50 Copay Not Covered

- Non-Formulary $90 Copay Not Covered $80 Copay Not Covered

- Supply Limit 90 Days N/A 90 Days N/A

Cost Per Pay Period Aetna OAMC POS Aetna OAMC POS

(26 per year) PPO HSA

Employee: Under10 Yrs

- Employee $94.58 $33.63

- Employee + spouse $193.37 $147.13

- Employee + child(ren) $199.67 $121.06

- Employee + family $241.71 $208.08

Employee: Over 10 Yrs

- Employee $84.07 $33.63

- Employee + spouse $178.65 $147.13

- Employee + child(ren) $203.88 $121.06

- Employee + family $262.73 $208.08

*The total telemedicine (Teladoc) cost for the Aetna OAMC POS HSA plan is $40 until the deductible is met. Then coinsurance

applies to the $40 (20% of $40).

MURAD EMPLOYEE BENEFITS 7