Page 6 - UP_Benefits_2020_NonCA_Store

P. 6

MEDICAL PLANS

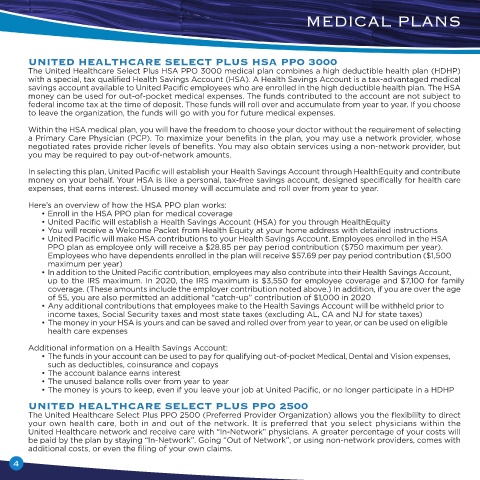

UNITED HEALTHCARE SELECT PLUS HSA PPO 3000

The United Healthcare Select Plus HSA PPO 3000 medical plan combines a high deductible health plan (HDHP)

with a special, tax qualified Health Savings Account (HSA). A Health Savings Account is a tax-advantaged medical

savings account available to United Pacific employees who are enrolled in the high deductible health plan. The HSA

money can be used for out-of-pocket medical expenses. The funds contributed to the account are not subject to HSA PPO 3000 PPO 2500

federal income tax at the time of deposit. These funds will roll over and accumulate from year to year. If you choose SELECT PLUS NON-NETWORK SELECT PLUS PPO NON-NETWORK

to leave the organization, the funds will go with you for future medical expenses. NETWORK NETWORK

Annual Deductible

Within the HSA medical plan, you will have the freedom to choose your doctor without the requirement of selecting

a Primary Care Physician (PCP). To maximize your benefits in the plan, you may use a network provider, whose Individual $3,000 $3,000 $2,500 $4,500

negotiated rates provide richer levels of benefits. You may also obtain services using a non-network provider, but *Family $6,000 $6,000 $5,000 $9,000

you may be required to pay out-of-network amounts. Coinsurance (You Pay) 20% 40% 20% 50%

Physician Office Visits

In selecting this plan, United Pacific will establish your Health Savings Account through HealthEquity and contribute Primary Care Physician Deductible, 20% Deductible, 40% $20 Copay Deductible, 50%

money on your behalf. Your HSA is like a personal, tax-free savings account, designed specifically for health care Specialist Deductible, 20% Deductible, 40% $40 Copay Deductible, 50%

expenses, that earns interest. Unused money will accumulate and roll over from year to year. Lab & X-Ray Deductible, 20% Deductible, 40% No Charge Deductible, 50%

Complex Deductible, 20% Deductible, 40% Deductible, 20% Deductible, 50%

Here’s an overview of how the HSA PPO plan works: Out-of-Pocket Maximum

• Enroll in the HSA PPO plan for medical coverage Individual $5,000 $10,000 $4,000 $10,000

• United Pacific will establish a Health Savings Account (HSA) for you through HealthEquity *Family $10,000 $20,000 $8,000 $20,000

• You will receive a Welcome Packet from Health Equity at your home address with detailed instructions Hospitalization

• United Pacific will make HSA contributions to your Health Savings Account. Employees enrolled in the HSA Inpatient Deductible, 20% Deductible, 40% Deductible, 20% Deductible, 50%

PPO plan as employee only will receive a $28.85 per pay period contribution ($750 maximum per year).

Employees who have dependents enrolled in the plan will receive $57.69 per pay period contribution ($1,500 Outpatient Deductible, 20% Deductible, 40% Deductible, 20% Deductible, 50%

maximum per year)

• In addition to the United Pacific contribution, employees may also contribute into their Health Savings Account, Emergency Services Deductible, 20% Deductible, 20% $250 Copay $250 Copay

up to the IRS maximum. In 2020, the IRS maximum is $3,550 for employee coverage and $7,100 for family Urgent Care Deductible, 20% Deductible, 40% $50 Copay Deductible, 50%

coverage. (These amounts include the employer contribution noted above.) In addition, if you are over the age

of 55, you are also permitted an additional “catch-up” contribution of $1,000 in 2020 Preventive Care No Charge Not Covered No Charge Not Covered

• Any additional contributions that employees make to the Health Savings Account will be withheld prior to Prescription Drugs Deductible Applies Deductible Applies

income taxes, Social Security taxes and most state taxes (excluding AL, CA and NJ for state taxes) Retail (30 Day Supply)

• The money in your HSA is yours and can be saved and rolled over from year to year, or can be used on eligible Tier 1 $15 Copay $15 Copay $10 Copay $10 Copay

health care expenses Tier 2 $40 Copay $40 Copay $35 Copay $35 Copay

$75 Copay

$60 Copay

$75 Copay

$60 Copay

Tier 3

Tier 4 Applicable Copay Applicable Copay 30% to $250 30% to $250

Additional information on a Health Savings Account: Mail Order (90 Day Supply)

• The funds in your account can be used to pay for qualifying out-of-pocket Medical, Dental and Vision expenses, Tier 1 $30 Copay Not Covered $25 Copay Not Covered

such as deductibles, coinsurance and copays Tier 2 $80 Copay Not Covered $87.50 Copay Not Covered

• The account balance earns interest Tier 3 $120 Copay Not Covered $187.50 Copay Not Covered

• The unused balance rolls over from year to year Tier 4 Applicable Copay Not Covered 30% to $625 Not Covered

• The money is yours to keep, even if you leave your job at United Pacific, or no longer participate in a HDHP

EMPLOYEE RATE PER PAYCHECK (based on 26 pay periods)

UNITED HEALTHCARE SELECT PLUS PPO 2500 Employee Only $47.91 $127.17

The United Healthcare Select Plus PPO 2500 (Preferred Provider Organization) allows you the flexibility to direct Employee + Spouse $262.24 $436.60

your own health care, both in and out of the network. It is preferred that you select physicians within the Employee + Child(ren) $190.79 $333.45

United Healthcare network and receive care with “In-Network” physicians. A greater percentage of your costs will Employee + Family $423.00 $668.69

be paid by the plan by staying “In-Network”. Going “Out of Network”, or using non-network providers, comes with

additional costs, or even the filing of your own claims. *No one member will pay more than the individual deductible and individual out-of-pocket maximum.

4 5