Page 15 - Lyon Benefits Guide 01-18 National - FINAL

P. 15

[EMPLOYEE BENEFITS]

MEDICAL - HOW THE HSA WORKS MEDICAL - WELLNESS PROGRAM

A Health Savings Account (HSA) is a tax-advantaged account that you own. In 2018, Lyon Living will make the following per pay As a United Healthcare medical participant, you and your covered spouse are provided the SimplyEngaged/Rally wellness program at

period HSA contributions of $9.62 per employee, $19.23 per employee + 1 dependent, and $28.85 per employee + family. Lyon Living’s no cost to you. SimplyEngaged /Rally is a personal health and wellness program which allows you to earn rewards when you complete

contribution will be deposited into your account whether or not you decide to make your own contributions. In addition to Lyon Living’s the health and wellness actions shown below. It’s easy to start earning rewards! You can access the rewards program when you log

contribution, you may elect to contribute into your account up to IRS maximums. IRS maximums for 2018 are $3,450 for employee into www.myuhc.com.

coverage and $6,850 for family coverage. If you are 55 years of age or older in 2018, the IRS also permits you an additional catch-up

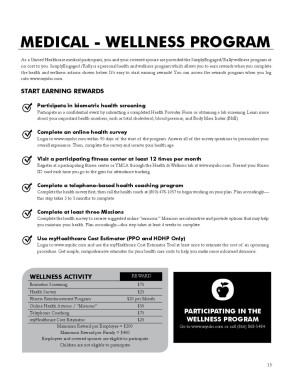

contribution of $1,000. The portion of your paycheck that you contribute to your HSA will be taken out before you pay federal income START EARNING REWARDS

taxes, Social Security taxes and most state taxes (excluding state taxes in AL, CA and NJ). Any contributions you make can be increased

or decreased over the course of the year. Participate in biometric health screening

Participate in a confidential event by submitting a completed Health Provider Form or obtaining a lab screening. Learn more

You can decide how to manage your money. The money in your HSA is yours to save and spend on eligible health care expenses whenever about your important health numbers, such as total cholesterol, blood pressure, and Body Mass Index (BMI).

you need it, whether in this plan year or in future plan years. You can use the funds in your account to pay tax-free for qualifying out-

of-pocket Medical, Dental and Vision expenses such as deductibles, coinsurance and copays. Your account balance earns interest and

the unused balance rolls-over from year to year. The money is yours to keep even if you leave Lyon Living, no longer participate in a Complete an online health survey

high deductible health plan (like the HDHP with HSA), or retire. You may continue to make contributions to your HSA if you enroll Login to www.myuhc.com within 90 days of the start of the program. Answer all of the survey questions to personalize your

in another qualified high deductible health plan, or elect COBRA continuation coverage of your HDHP with HSA coverage if your overall experience. Then, complete the survey and receive your health age.

employment terminates.

Visit a participating fitness center at least 12 times per month

Eligible HSA Expenses Include: Register at a participating fitness center or YMCA through the Health & Wellness tab at www.myuhc.com. Present your fitness

ID card each time you go to the gym for attendance tracking.

Medical Dental Vision Premiums

• Doctors/Nurses • Durable Medical • Dentists • Optometrists • COBRA Complete a telephone-based health coaching program

• Prescription Drugs Equipment • Orthodontists • Ophthalmologists • Long-Term Care Complete the health survey first, then call the health coach at (800) 478-1057 to begin working on your plan. Plan accordingly—

• Hospital • Artificial Limbs • Periodontists • Exams • Medicare this step takes 3 to 5 months to complete.

• Ambulance • Sterilization • Teeth Cleaning • Glasses

• Lab work • Acupuncture • X-Rays • Contact Lenses Complete at least three Missions

• X-Ray • Chiropractic • Fluoride • Lasik Surgery Complete the health survey to receive suggested online “missions.” Missions are interactive and provide options that may help

• Insulin Treatment Treatments you maintain your health. Plan accordingly—this step takes at least 4 weeks to complete.

Ineligible HSA expenses include expenses that are not medical or health related as well as cosmetic surgery.

Use myHealthcare Cost Estimator (PPO and HDHP Only)

Login to www.myuhc.com and use the myHealthcare Cost Estimator Tool at least once to estimate the cost of an upcoming

HSA SAVINGS COMPARISON procedure. Get simple, comprehensive estimates for your health care costs to help you make more informed decisions.

WITHOUT THE HSA WITH THE HSA

Gross Annual Pay $45,000 $45,000

Employee pre-tax HSA contributions used to Not Elected $1,200 WELLNESS ACTIVITY REWARD

pay for annual healthcare expenses (deductibles, Biometric Screening $75

copays, prescription drugs, dental expenses,

vision expenses, etc.) Health Survey $25

Taxable Gross Income $45,000 $43,800 Fitness Reimbursement Program $20 per Month

Payroll Taxes (at 30%) $13,500 $13,140 Online Health Actions / “Missions” $50 PARTICIPATING IN THE

Employee-Funded HSA Bank Account $1,200 $0 Telephonic Coaching $75

Net Pay $30,300 $30,660 myHealthcare Cost Estimator $25 WELLNESS PROGRAM

Annual Savings with Pre-Tax HSA Deduction $0 $360 Maximum Reward per Employee = $200 Go to www.myuhc.com or call (866) 868-5484.

Maximum Reward per Family = $400

Employees and covered spouses are eligible to participate

Children are not eligible to participate

14 15