Page 27 - QSC Benefits Guide 7-18 SLO

P. 27

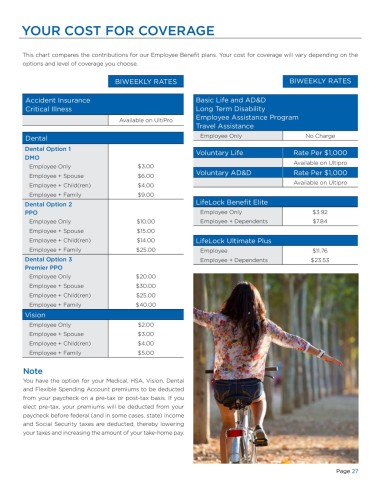

YOUR COST FOR COVERAGE

This chart compares the contributions for our Employee Benefit plans. Your cost for coverage will vary depending on the

options and level of coverage you choose.

BIWEEKLY RATES BIWEEKLY RATES

Accident Insurance Basic Life and AD&D

Critical Illness Long Term Disability

Employee Assistance Program

Available on UltiPro

Travel Assistance

Dental Employee Only No Charge

Dental Option 1 Voluntary Life Rate Per $1,000

DMO

Employee Only $3.00 Available on Ultipro

Employee + Spouse $6.00 Voluntary AD&D Rate Per $1,000

Employee + Child(ren) $4.00 Available on Ultipro

Employee + Family $9.00

Dental Option 2 LifeLock Benefit Elite

PPO Employee Only $3.92

Employee Only $10.00 Employee + Dependents $7.84

Employee + Spouse $15.00

Employee + Child(ren) $14.00 LifeLock Ultimate Plus

Employee + Family $25.00 Employee $11.76

Dental Option 3 Employee + Dependents $23.53

Premier PPO

Employee Only $20.00

Employee + Spouse $30.00

Employee + Child(ren) $25.00

Employee + Family $40.00

Vision

Employee Only $2.00

Employee + Spouse $3.00

Employee + Child(ren) $4.00

Employee + Family $5.00

Note

You have the option for your Medical, HSA, Vision, Dental

and Flexible Spending Account premiums to be deducted

from your paycheck on a pre-tax or post-tax basis. If you

elect pre-tax, your premiums will be deducted from your

paycheck before federal (and in some cases, state) income

and Social Security taxes are deducted, thereby lowering

your taxes and increasing the amount of your take-home pay.

Page 27