Page 17 - Work Life and Benefits Booklet 2018 - SW

P. 17

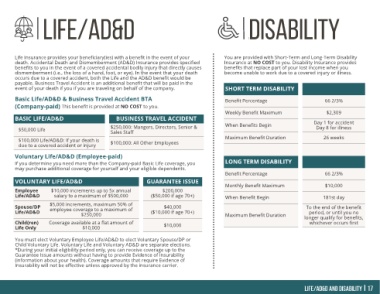

Life Insurance provides your beneficiary(ies) with a benefit in the event of your You are provided with Short-Term and Long-Term Disability

death. Accidental Death and Dismemberment (AD&D) Insurance provides specified Insurance at NO COST to you. Disability Insurance provides

benefits to you in the event of a covered accidental bodily injury that directly causes benefits that replace part of your lost income when you

dismemberment (i.e., the loss of a hand, foot, or eye). In the event that your death become unable to work due to a covered injury or illness.

occurs due to a covered accident, both the Life and the AD&D benefit would be

payable. Business Travel Accident is an additional benefit that will be paid in the

event of your death if you if you are traveling on behalf of the company. SHORT TERM DISABILITY

Basic Life/AD&D & Business Travel Accident BTA Benefit Percentage 66 2/3%

(Company-paid) This benefit is provided at NO COST to you.

Weekly Benefit Maximum $2,309

BASIC LIFE/AD&D BUSINESS TRAVEL ACCIDENT

$250,000: Mangers, Directors, Senior & When Benefits Begin Day 1 for accident

Day 8 for illness

$50,000 Life

Sales Staff

$100,000 Life/AD&D: If your death is Maximum Benefit Duration 26 weeks

due to a covered accident or injury $100,000: All Other Employees

Voluntary Life/AD&D (Employee-paid)

If you determine you need more than the Company-paid Basic Life coverage, you LONG TERM DISABILITY

may purchase additional coverage for yourself and your eligible dependents.

Benefit Percentage 66 2/3%

VOLUNTARY LIFE/AD&D GUARANTEE ISSUE Monthly Benefit Maximum $10,000

Employee $10,000 increments up to 5x annual $200,000

Life/AD&D salary to a maximum of $500,000 ($50,000 if age 70+) When Benefit Begin 181st day

$5,000 increments, maximum 50% of

Spouse/DP $40,000 To the end of the benefit

Life/AD&D employee coverage to a maximum of ($10,000 if age 70+) Maximum Benefit Duration period, or until you no

$250,000

Child(ren) Coverage available at a flat amount of $10,000 longer qualify for benefits,

whichever occurs first

Life Only $10,000

You must elect Voluntary Employee Life/AD&D to elect Voluntary Spouse/DP or

Child Voluntary Life. Voluntary Life and Voluntary AD&D are separate elections.

*During your initial eligibility period only, you can receive coverage up to the

Guarantee Issue amounts without having to provide Evidence of Insurability

(information about your health). Coverage amounts that require Evidence of

Insurability will not be effective unless approved by the insurance carrier.