Page 6 - Oremor EE Guide 01-18_FINAL1

P. 6

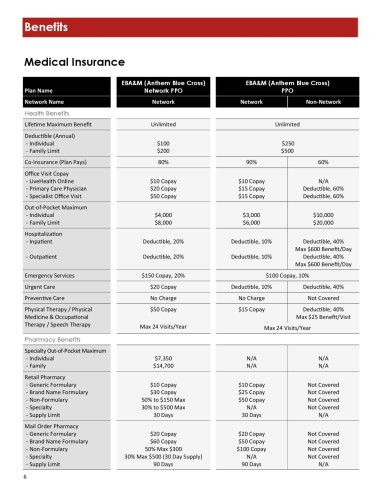

Benefits

Medical Insurance

EBA&M (Anthem Blue Cross) EBA&M (Anthem Blue Cross)

Plan Name Network PPO PPO

Network Name Network Network Non-Network

Health Benefits

Lifetime Maximum Benefit Unlimited Unlimited

Deductible (Annual)

- Individual $100 $250

- Family Limit $200 $500

Co-Insurance (Plan Pays) 80% 90% 60%

Office Visit Copay

- LiveHealth Online $10 Copay $10 Copay N/A

- Primary Care Physician $20 Copay $15 Copay Deductible, 60%

- Specialist Office Visit $50 Copay $15 Copay Deductible, 60%

Out-of-Pocket Maximum

- Individual $4,000 $3,000 $10,000

- Family Limit $8,000 $6,000 $20,000

Hospitalization

- Inpatient Deductible, 20% Deductible, 10% Deductible, 40%

Max $600 Benefit/Day

- Outpatient Deductible, 20% Deductible, 10% Deductible, 40%

Max $600 Benefit/Day

Emergency Services $150 Copay, 20% $100 Copay, 10%

Urgent Care $20 Copay Deductible, 10% Deductible, 40%

Preventive Care No Charge No Charge Not Covered

Physical Therapy / Physical $50 Copay $15 Copay Deductible, 40%

Medicine & Occupational Max $25 Benefit/Visit

Therapy / Speech Therapy

Max 24 Visits/Year Max 24 Visits/Year

Pharmacy Benefits

Specialty Out-of-Pocket Maximum

- Individual $7,350 N/A N/A

- Family $14,700 N/A N/A

Retail Pharmacy

- Generic Formulary $10 Copay $10 Copay Not Covered

- Brand Name Formulary $30 Copay $25 Copay Not Covered

- Non-Formulary 50% to $150 Max $50 Copay Not Covered

- Specialty 30% to $500 Max N/A Not Covered

- Supply Limit 30 Days 30 Days N/A

Mail Order Pharmacy

- Generic Formulary $20 Copay $20 Copay Not Covered

- Brand Name Formulary $60 Copay $50 Copay Not Covered

- Non-Formulary 50% Max $300 $100 Copay Not Covered

- Specialty 30% Max $500 (30 Day Supply) N/A Not Covered

- Supply Limit 90 Days 90 Days N/A

6