Page 11 - Dynacraft Benefit Summary 2020_NonExecutives

P. 11

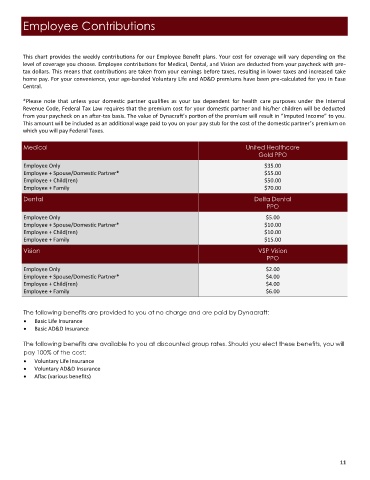

Employee Contributions

This chart provides the weekly contributions for our Employee Benefit plans. Your cost for coverage will vary depending on the

level of coverage you choose. Employee contributions for Medical, Dental, and Vision are deducted from your paycheck with pre-

tax dollars. This means that contributions are taken from your earnings before taxes, resulting in lower taxes and increased take

home pay. For your convenience, your age-banded Voluntary Life and AD&D premiums have been pre-calculated for you in Ease

Central.

*Please note that unless your domestic partner qualifies as your tax dependent for health care purposes under the Internal

Revenue Code, Federal Tax Law requires that the premium cost for your domestic partner and his/her children will be deducted

from your paycheck on an after-tax basis. The value of Dynacraft’s portion of the premium will result in “Imputed Income” to you.

This amount will be included as an additional wage paid to you on your pay stub for the cost of the domestic partner’s premium on

which you will pay Federal Taxes.

Medical United Healthcare

Gold PPO

Employee Only $35.00

Employee + Spouse/Domestic Partner* $55.00

Employee + Child(ren) $50.00

Employee + Family $70.00

Dental Delta Dental

PPO

Employee Only $5.00

Employee + Spouse/Domestic Partner* $10.00

Employee + Child(ren) $10.00

Employee + Family $15.00

Vision VSP Vision

PPO

Employee Only $2.00

Employee + Spouse/Domestic Partner* $4.00

Employee + Child(ren) $4.00

Employee + Family $6.00

The following benefits are provided to you at no charge and are paid by Dynacraft:

• Basic Life Insurance

• Basic AD&D Insurance

The following benefits are available to you at discounted group rates. Should you elect these benefits, you will

pay 100% of the cost:

• Voluntary Life Insurance

• Voluntary AD&D Insurance

• Aflac (various benefits)

11