Page 16 - Work Life and Benefits Booklet 2018 - SS

P. 16

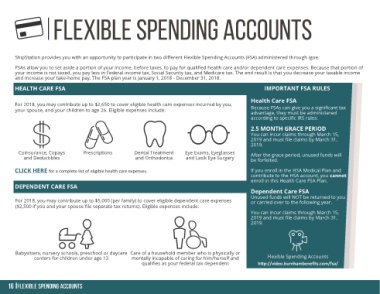

ShipStation provides you with an opportunity to participate in two different Flexible Spending Accounts (FSA) administered through Igoe.

FSAs allow you to set aside a portion of your income, before taxes, to pay for qualified health care and/or dependent care expenses. Because that portion of

your income is not taxed, you pay less in Federal income tax, Social Security tax, and Medicare tax. The end result is that you decrease your taxable income

and increase your take-home pay. The FSA plan year is January 1, 2018 - December 31, 2018.

HEALTH CARE FSA IMPORTANT FSA RULES

Health Care FSA

For 2018, you may contribute up to $2,650 to cover eligible health care expenses incurred by you,

your spouse, and your children to age 26. Eligible expenses include: Because FSAs can give you a significant tax

advantage, they must be administered

according to specific IRS rules:

2.5 MONTH GRACE PERIOD

You can incur claims through March 15,

2019 and must file claims by March 31,

2019.

Coinsurance, Copays Prescriptions Dental Treatment Eye Exams, Eyeglasses After the grace period, unused funds will

and Deductibles and Orthodontia and Lasik Eye Surgery be forfeited.

CLICK HERE for a complete list of eligible health care expenses. If you enroll in the HSA Medical Plan and

contribute to the HSA account, you cannot

enroll in this Health Care FSA Plan.

DEPENDENT CARE FSA

Dependent Care FSA

Unused funds will NOT be returned to you

For 2018, you may contribute up to $5,000 (per family) to cover eligible dependent care expenses or carried over to the following year.

($2,500 if you and your spouse file separate tax returns). Eligible expenses include:

You can incur claims through March 15,

2019 and must file claims by March 31,

2019.

Babysitters, nursery schools, preschool or daycare Care of a household member who is physically or Educational Video

centers for children under age 13 mentally incapable of caring for him/herself and Flexible Spending Accounts

qualifies as your federal tax dependent http://video.burnhambenefits.com/fsa/