Page 9 - Veritone EE Guide 07-19

P. 9

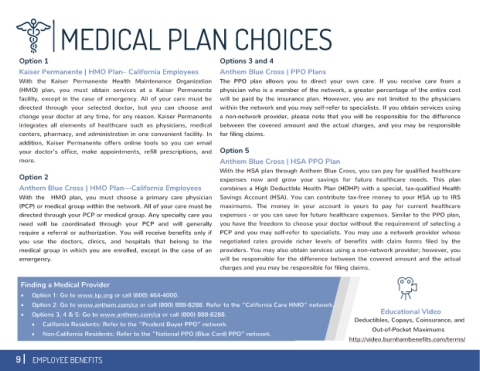

Option 1 Options 3 and 4

Kaiser Permanente | HMO Plan– California Employees Anthem Blue Cross | PPO Plans

With the Kaiser Permanente Health Maintenance Organization The PPO plan allows you to direct your own care. If you receive care from a

(HMO) plan, you must obtain services at a Kaiser Permanente physician who is a member of the network, a greater percentage of the entire cost

facility, except in the case of emergency. All of your care must be will be paid by the insurance plan. However, you are not limited to the physicians

directed through your selected doctor, but you can choose and within the network and you may self-refer to specialists. If you obtain services using

change your doctor at any time, for any reason. Kaiser Permanente a non-network provider, please note that you will be responsible for the difference

integrates all elements of healthcare such as physicians, medical between the covered amount and the actual charges, and you may be responsible

centers, pharmacy, and administration in one convenient facility. In for filing claims.

addition, Kaiser Permanente offers online tools so you can email

your doctor’s office, make appointments, refill prescriptions, and Option 5

more. Anthem Blue Cross | HSA PPO Plan

With the HSA plan through Anthem Blue Cross, you can pay for qualified healthcare

Option 2 expenses now and grow your savings for future healthcare needs. This plan

Anthem Blue Cross | HMO Plan—California Employees combines a High Deductible Health Plan (HDHP) with a special, tax-qualified Health

With the HMO plan, you must choose a primary care physician Savings Account (HSA). You can contribute tax-free money to your HSA up to IRS

(PCP) or medical group within the network. All of your care must be maximums. The money in your account is yours to pay for current healthcare

directed through your PCP or medical group. Any specialty care you expenses - or you can save for future healthcare expenses. Similar to the PPO plan,

need will be coordinated through your PCP and will generally you have the freedom to choose your doctor without the requirement of selecting a

require a referral or authorization. You will receive benefits only if PCP and you may self-refer to specialists. You may use a network provider whose

you use the doctors, clinics, and hospitals that belong to the negotiated rates provide richer levels of benefits with claim forms filed by the

medical group in which you are enrolled, except in the case of an providers. You may also obtain services using a non-network provider; however, you

emergency. will be responsible for the difference between the covered amount and the actual

charges and you may be responsible for filing claims.

Finding a Medical Provider

· Option 1: Go to www.kp.org or call (800) 464-4000.

· Option 2: Go to www.anthem.com/ca or call (800) 888-8288. Refer to the “California Care HMO” network.

· Options 3, 4 & 5: Go to www.anthem.com/ca or call (800) 888-8288. Educational Video

· California Residents: Refer to the “Prudent Buyer PPO” network. Deductibles, Copays, Coinsurance, and

· Non-California Residents: Refer to the “National PPO (Blue Card) PPO” network. Out-of-Pocket Maximums

http://video.burnhambenefits.com/terms/