Page 12 - Rauxa EE Guide 04-18 CA

P. 12

Medical Insurance

Health Savings Account: It’s as easy as 1-2-3!

The opportunity to establish and contribute to a Health Savings Account is available when you elect the HSA Medical

option. It’s like a personal, tax-free savings account for health care expenses that earns interest. Any unused money rolls

over from year to year.

Here’s an overview of how it works:

1. You enroll in the HSA plan for Medical coverage and establish your HSA with Health Equity online during open

enrollment or any time during the year. You will receive a Welcome Packet at your home address with detailed

instructions on how to administer your HSA.

2. In 2018, Rauxa will make per paycheck HSA contributions of $20 per employee and family. These contributions can

total as much as $480 for the year. Rauxa’s contribution will be deposited in your account whether or not you decide

to make your own contributions. In addition to Rauxa’s contribution, you may elect to make contributions into your

account up to IRS maximums. In 2018, the IRS allows deferrals up to $3,450 for employee coverage and up to $6,900

for family coverage. If you are age 55 or older, you are also permitted an additional catch-up contribution of $1,000

for 2018. The portion of your paycheck that you contribute to your HSA will be taken out before you pay federal

income taxes, Social Security taxes and most state taxes (excluding state taxes in AL, CA and NJ). Any contributions

you make can be increased or decreased over the course of the year.

3. You can decide how to manage your money. The money in your HSA is yours to save and spend on eligible health

care expenses whenever you need it, whether in 2018 or during a later year. You can use the funds in your account

to pay tax-free for qualifying out-of-pocket Medical, Dental and Vision expenses such as deductibles, coinsurance

and copays. Your account balance earns interest and the unused balance rolls-over from year to year. The money is

yours to keep even if you leave Rauxa, no longer participate in a high deductible health plan (like the HSA Medical

plan), or retire. You may continue to make contributions to your HSA if you enroll in another qualified high deductible

health plan, or elect COBRA continuation coverage of your HSA coverage if your employment terminates.

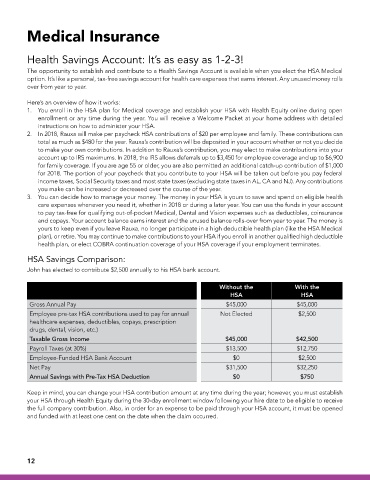

HSA Savings Comparison:

John has elected to contribute $2,500 annually to his HSA bank account.

Without the With the

HSA HSA

Gross Annual Pay $45,000 $45,000

Employee pre-tax HSA contributions used to pay for annual Not Elected $2,500

healthcare expenses, deductibles, copays, prescription

drugs, dental, vision, etc.)

Taxable Gross Income $45,000 $42,500

Payroll Taxes (at 30%) $13,500 $12,750

Employee-Funded HSA Bank Account $0 $2,500

Net Pay $31,500 $32,250

Annual Savings with Pre-Tax HSA Deduction $0 $750

Keep in mind, you can change your HSA contribution amount at any time during the year; however, you must establish

your HSA through Health Equity during the 30-day enrollment window following your hire date to be eligible to receive

the full company contribution. Also, in order for an expense to be paid through your HSA account, it must be opened

and funded with at least one cent on the date when the claim occurred.

12