Page 17 - Ria Benefits Guide 2020 FINAL CA

P. 17

Income Protection

UNUM | LONG-TERM DISABILITY

Ria provides eligible employees the opportunity to purchase Long-Term Disability (LTD) benefits through Unum on a voluntary basis. If

you experience a disabling condition, LTD benefits provide continued compensation paid on a monthly basis.

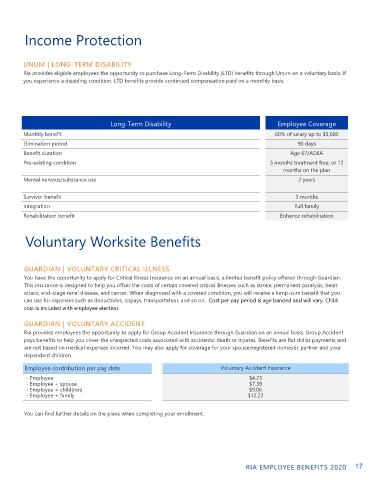

Long-Term Disability Employee Coverage

Monthly benefit 60% of salary up to $5,000

Elimination period 90 days

Benefit duration Age 67/ADEA

Pre-existing condition 3 months treatment free; or 12

months on the plan

Mental nervous/substance use 2 years

Survivor benefit 3 months

Integration Full family

Rehabilitation benefit Enhance rehabilitation

Voluntary Worksite Benefits

GUARDIAN | VOLUNTARY CRITICAL ILLNESS

You have the opportunity to apply for Critical Illness Insurance on an annual basis, a limited benefit policy offered through Guardian.

This insurance is designed to help you offset the costs of certain covered critical illnesses such as stroke, permanent paralysis, heart

attack, end-stage renal disease, and cancer. When diagnosed with a covered condition, you will receive a lump-sum benefit that you

can use for expenses such as deductibles, copays, transportation, and so on. Cost per pay period is age banded and will vary. Child

cost is included with employee election.

GUARDIAN | VOLUNTARY ACCIDENT

Ria provides employees the opportunity to apply for Group Accident Insurance through Guardian on an annual basis. Group Accident

pays benefits to help you cover the unexpected costs associated with accidental death or injuries. Benefits are flat dollar payments and

are not based on medical expenses incurred. You may also apply for coverage for your spouse/registered domestic partner and your

dependent children.

Employee contribution per pay date Voluntary Accident Insurance

- Employee $4.23

- Employee + spouse $7.39

- Employee + child(ren) $9.06

- Employee + family $12.22

You can find further details on the plans when completing your enrollment.

RIA EMPLOYEE BENEFITS 2020 17