Page 21 - open_enrollment_benefits_book_CA_2018_v4

P. 21

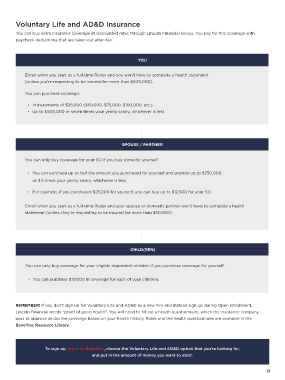

Voluntary Life and AD&D Insurance

You can buy extra insurance coverage at discounted rates through Lincoln Financial Group. You pay for this coverage with

paycheck deductions that are taken out after-tax.

YOU

Enroll when you start as a full-time Rioter and you won’t have to complete a health statement

(unless you’re requesting to be insured for more than $200,000).

You can purchase coverage:

• In increments of $25,000 ($50,000, $75,000, $100,000, etc.).

• Up to $500,000 or seven times your yearly salary, whichever is less.

SPOUSE / PARTNER

You can only buy coverage for your SO if you buy some for yourself.

• You can purchase up to half the amount you purchased for yourself and provide up to $250,000

or 3.5 times your yearly salary, whichever is less.

• For example, if you purchased $25,000 for yourself, you can buy up to $12,500 for your SO.

Enroll when you start as a full-time Rioter and your spouse or domestic partner won’t have to complete a health

statement (unless they’re requesting to be insured for more than $50,000).

CHILD(REN)

You can only buy coverage for your eligible dependent children if you purchase coverage for yourself.

• You can purchase $10,000 in coverage for each of your children.

REMEMBER! If you don’t sign up for Voluntary Life and AD&D as a new hire and instead sign up during Open Enrollment,

Lincoln Financial needs “proof of good health”. You will need to fill out a health questionnaire, which the insurance company

uses to approve or decline coverage based on your health history. Rates and the health questionnaire are available in the

BeneTrac Resource Library.

To sign up, log in to BeneTrac, choose the Voluntary Life and AD&D option that you’re looking for,

and put in the amount of money you want to elect.

17