Page 17 - FSSI EE Guide 07-20 - OOS

P. 17

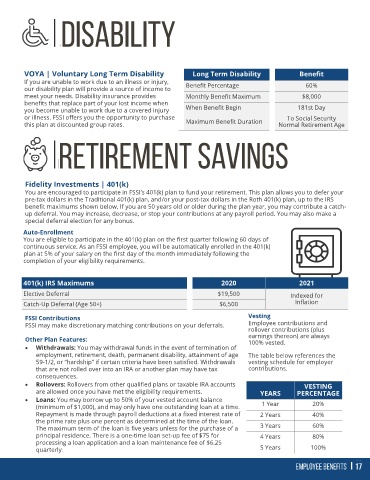

VOYA | Voluntary Long Term Disability Long Term Disability Benefit

If you are unable to work due to an illness or injury, Benefit Percentage 60%

our disability plan will provide a source of income to

meet your needs. Disability insurance provides Monthly Benefit Maximum $8,000

benefits that replace part of your lost income when

you become unable to work due to a covered injury When Benefit Begin 181st Day

or illness. FSSI offers you the opportunity to purchase To Social Security

this plan at discounted group rates. Maximum Benefit Duration Normal Retirement Age

Fidelity Investments | 401(k)

You are encouraged to participate in FSSI’s 401(k) plan to fund your retirement. This plan allows you to defer your

pre-tax dollars in the Traditional 401(k) plan, and/or your post-tax dollars in the Roth 401(k) plan, up to the IRS

benefit maximums shown below. If you are 50 years old or older during the plan year, you may contribute a catch-

up deferral. You may increase, decrease, or stop your contributions at any payroll period. You may also make a

special deferral election for any bonus.

Auto-Enrollment

You are eligible to participate in the 401(k) plan on the first quarter following 60 days of

continuous service. As an FSSI employee, you will be automatically enrolled in the 401(k)

plan at 5% of your salary on the first day of the month immediately following the

completion of your eligibility requirements.

401(k) IRS Maximums 2020 2021

Elective Deferral $19,500 Indexed for

Catch-Up Deferral (Age 50+) $6,500 Inflation

FSSI Contributions Vesting

FSSI may make discretionary matching contributions on your deferrals. Employee contributions and

rollover contributions (plus

earnings thereon) are always

Other Plan Features: 100% vested.

• Withdrawals: You may withdrawal funds in the event of termination of

employment, retirement, death, permanent disability, attainment of age The table below references the

59-1/2, or “hardship” if certain criteria have been satisfied. Withdrawals vesting schedule for employer

that are not rolled over into an IRA or another plan may have tax contributions.

consequences.

• Rollovers: Rollovers from other qualified plans or taxable IRA accounts VESTING

are allowed once you have met the eligibility requirements. YEARS PERCENTAGE

• Loans: You may borrow up to 50% of your vested account balance

(minimum of $1,000), and may only have one outstanding loan at a time. 1 Year 20%

Repayment is made through payroll deductions at a fixed interest rate of 2 Years 40%

the prime rate plus one percent as determined at the time of the loan.

The maximum term of the loan is five years unless for the purchase of a 3 Years 60%

principal residence. There is a one-time loan set-up fee of $75 for 4 Years 80%

processing a loan application and a loan maintenance fee of $6.25

quarterly. 5 Years 100%