Page 11 - Work Life and Benefits Booklet 2020 SW

P. 11

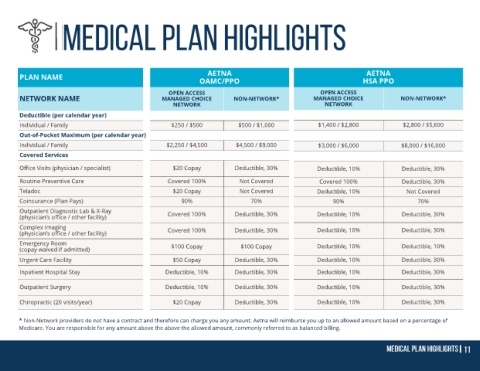

AETNA AETNA

PLAN NAME OAMC/PPO HSA PPO

OPEN ACCESS OPEN ACCESS

NETWORK NAME MANAGED CHOICE NON-NETWORK* MANAGED CHOICE NON-NETWORK*

NETWORK NETWORK

Deductible (per calendar year)

Individual / Family $250 / $500 $500 / $1,000 $1,400 / $2,800 $2,800 / $5,600

Out-of-Pocket Maximum (per calendar year)

Individual / Family $2,250 / $4,500 $4,500 / $9,000 $3,000 / $6,000 $8,000 / $16,000

Covered Services

Office Visits (physician / specialist) $20 Copay Deductible, 30% Deductible, 10% Deductible, 30%

Routine Preventive Care Covered 100% Not Covered Covered 100% Deductible, 30%

Teladoc $20 Copay Not Covered Deductible, 10% Not Covered

Coinsurance (Plan Pays) 90% 70% 90% 70%

Outpatient Diagnostic Lab & X-Ray Covered 100% Deductible, 30% Deductible, 10% Deductible, 30%

(physician’s office / other facility)

Complex Imaging Covered 100% Deductible, 30% Deductible, 10% Deductible, 30%

(physician’s office / other facility)

Emergency Room $100 Copay $100 Copay Deductible, 10% Deductible, 10%

(copay waived if admitted)

Urgent Care Facility $50 Copay Deductible, 30% Deductible, 10% Deductible, 30%

Inpatient Hospital Stay Deductible, 10% Deductible, 30% Deductible, 10% Deductible, 30%

Outpatient Surgery Deductible, 10% Deductible, 30% Deductible, 10% Deductible, 30%

Chiropractic (20 visits/year) $20 Copay Deductible, 30% Deductible, 10% Deductible, 30%

* Non-Network providers do not have a contract and therefore can charge you any amount. Aetna will reimburse you up to an allowed amount based on a percentage of

Medicare. You are responsible for any amount above the above the allowed amount, commonly referred to as balanced billing.