Page 14 - Razer Benefits Guide 1-18 NATIONAL

P. 14

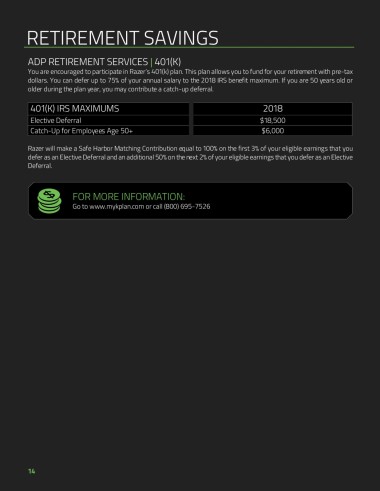

RETIREMENT SAVINGS

ADP RETIREMENT SERVICES | 401(K)

You are encouraged to participate in Razer’s 401(k) plan. This plan allows you to fund for your retirement with pre-tax

dollars. You can defer up to 75% of your annual salary to the 2018 IRS benefit maximum. If you are 50 years old or

older during the plan year, you may contribute a catch-up deferral.

401(K) IRS MAXIMUMS 2018

Elective Deferral $18,500

Catch-Up for Employees Age 50+ $6,000

Razer will make a Safe Harbor Matching Contribution equal to 100% on the first 3% of your eligible earnings that you

defer as an Elective Deferral and an additional 50% on the next 2% of your eligible earnings that you defer as an Elective

Deferral.

FOR MORE INFORMATION:

Go to www.mykplan.com or call (800) 695-7526

14