Page 9 - QSC EE Guide 01-20 SLO

P. 9

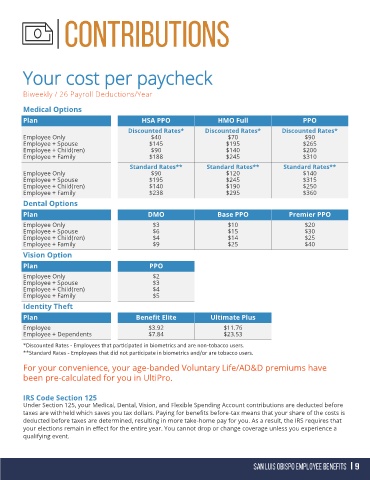

Your cost per paycheck

Biweekly / 26 Payroll Deductions/Year

Medical Options

Plan HSA PPO HMO Full PPO

Discounted Rates* Discounted Rates* Discounted Rates*

Employee Only $40 $70 $90

Employee + Spouse $145 $195 $265

Employee + Child(ren) $90 $140 $200

Employee + Family $188 $245 $310

Standard Rates** Standard Rates** Standard Rates**

Employee Only $90 $120 $140

Employee + Spouse $195 $245 $315

Employee + Child(ren) $140 $190 $250

Employee + Family $238 $295 $360

Dental Options

Plan DMO Base PPO Premier PPO

Employee Only $3 $10 $20

Employee + Spouse $6 $15 $30

Employee + Child(ren) $4 $14 $25

Employee + Family $9 $25 $40

Vision Option

Plan PPO

Employee Only $2

Employee + Spouse $3

Employee + Child(ren) $4

Employee + Family $5

Identity Theft

Plan Benefit Elite Ultimate Plus

Employee $3.92 $11.76

Employee + Dependents $7.84 $23.53

*Discounted Rates - Employees that participated in biometrics and are non-tobacco users.

**Standard Rates - Employees that did not participate in biometrics and/or are tobacco users.

For your convenience, your age-banded Voluntary Life/AD&D premiums have

been pre-calculated for you in UltiPro.

IRS Code Section 125

Under Section 125, your Medical, Dental, Vision, and Flexible Spending Account contributions are deducted before

taxes are withheld which saves you tax dollars. Paying for benefits before-tax means that your share of the costs is

deducted before taxes are determined, resulting in more take-home pay for you. As a result, the IRS requires that

your elections remain in effect for the entire year. You cannot drop or change coverage unless you experience a

qualifying event.