Page 7 - NickCo Mgmt Benefits Flipbook

P. 7

BENEFITS

Dental Insurance

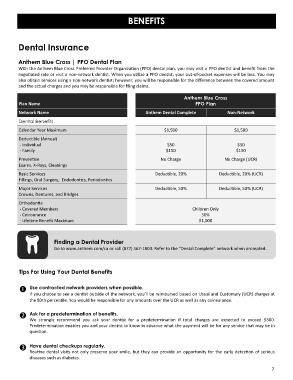

Anthem Blue Cross | PPO Dental Plan

With the Anthem Blue Cross Preferred Provider Organization (PPO) dental plan, you may visit a PPO dentist and benefit from the

negotiated rate or visit a non‐network dentist. When you utilize a PPO dentist, your out-of-pocket expenses will be less. You may

also obtain services using a non-network dentist; however, you will be responsible for the difference between the covered amount

and the actual charges and you may be responsible for filing claims.

Anthem Blue Cross

Plan Name PPO Plan

Network Name Anthem Dental Complete Non-Network

Dental Benefits

Calendar Year Maximum $1,500 $1,500

Deductible (Annual)

- Individual $50 $50

- Family $150 $150

Preventive No Charge No Charge (UCR)

Exams, X-Rays, Cleanings

Basic Services Deductible, 20% Deductible, 20% (UCR)

Fillings, Oral Surgery, Endodontics, Periodontics

Major Services Deductible, 50% Deductible, 50% (UCR)

Crowns, Dentures, and Bridges

Orthodontia

- Covered Members Children Only

- Coinsurance 50%

- Lifetime Benefit Maximum $1,000

Finding a Dental Provider

Go to www.anthem.com/ca or call (877) 567-1804. Refer to the “Dental Complete” network when prompted.

Tips For Using Your Dental Benefits

Use contracted network providers when possible.

If you choose to see a dentist outside of the network, you’ll be reimbursed based on Usual and Customary (UCR) charges at

the 80th percentile. You would be responsible for any amounts over the UCR as well as any coinsurance.

Ask for a predetermination of benefits.

We strongly recommend you ask your dentist for a predetermination if total charges are expected to exceed $300.

Predetermination enables you and your dentist to know in advance what the payment will be for any service that may be in

question.

Have dental checkups regularly.

Routine dental visits not only preserve your smile, but they can provide an opportunity for the early detection of serious

diseases such as diabetes.

7