Page 19 - Burnham EE Guide 01-20

P. 19

TAX SAVINGS BENEFITS TAX SAVINGS BENEFITS

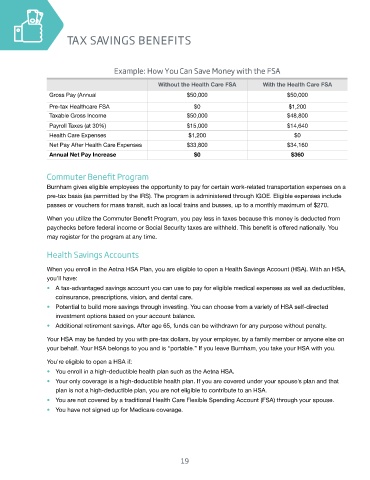

Example: How You Can Save Money with the FSA

Without the Health Care FSA With the Health Care FSA

Gross Pay (Annual $50,000 $50,000

Pre-tax Healthcare FSA $0 $1,200

Taxable Gross Income $50,000 $48,800

Payroll Taxes (at 30%) $15,000 $14,640

Health Care Expenses $1,200 $0

Net Pay After Health Care Expenses $33,800 $34,160

Annual Net Pay Increase $0 $360

Commuter Benefit Program

Burnham gives eligible employees the opportunity to pay for certain work-related transportation expenses on a

pre-tax basis (as permitted by the IRS). The program is administered through IGOE. Eligible expenses include

passes or vouchers for mass transit, such as local trains and busses, up to a monthly maximum of $270.

When you utilize the Commuter Benefit Program, you pay less in taxes because this money is deducted from

paychecks before federal income or Social Security taxes are withheld. This benefit is offered nationally. You

may register for the program at any time.

Health Savings Accounts

When you enroll in the Aetna HSA Plan, you are eligible to open a Health Savings Account (HSA). With an HSA,

you’ll have:

• A tax-advantaged savings account you can use to pay for eligible medical expenses as well as deductibles,

coinsurance, prescriptions, vision, and dental care.

• Potential to build more savings through investing. You can choose from a variety of HSA self-directed

investment options based on your account balance.

• Additional retirement savings. After age 65, funds can be withdrawn for any purpose without penalty.

Your HSA may be funded by you with pre-tax dollars, by your employer, by a family member or anyone else on

your behalf. Your HSA belongs to you and is “portable.” If you leave Burnham, you take your HSA with you.

You’re eligible to open a HSA if:

• You enroll in a high-deductible health plan such as the Aetna HSA.

• Your only coverage is a high-deductible health plan. If you are covered under your spouse’s plan and that

plan is not a high-deductible plan, you are not eligible to contribute to an HSA.

• You are not covered by a traditional Health Care Flexible Spending Account (FSA) through your spouse.

• You have not signed up for Medicare coverage.

19