Page 29 - open_enrollment_benefits_book_NA_2018_v4

P. 29

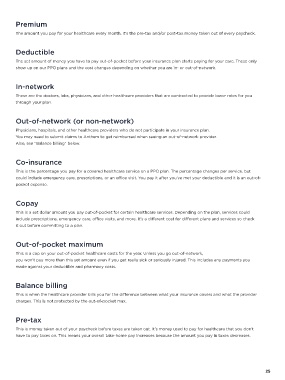

Premium

The amount you pay for your healthcare every month. It’s the pre-tax and/or post-tax money taken out of every paycheck.

Deductible

The set amount of money you have to pay out-of-pocket before your insurance plan starts paying for your care. These only

show up on our PPO plans and the cost changes depending on whether you are in- or out-of-network.

In-network

These are the doctors, labs, physicians, and other healthcare providers that are contracted to provide lower rates for you

through your plan.

Out-of-network (or non-network)

Physicians, hospitals, and other healthcare providers who do not participate in your insurance plan.

You may need to submit claims to Anthem to get reimbursed when seeing an out-of-network provider.

Also, see “Balance billing” below.

Co-insurance

This is the percentage you pay for a covered healthcare service on a PPO plan. The percentage changes per service, but

could include emergency care, prescriptions, or an office visit. You pay it after you’ve met your deductible and it is an out-of-

pocket expense.

Copay

This is a set dollar amount you pay out-of-pocket for certain healthcare services. Depending on the plan, services could

include prescriptions, emergency care, office visits, and more. It’s a different cost for different plans and services so check

it out before committing to a plan.

Out-of-pocket maximum

This is a cap on your out-of-pocket healthcare costs for the year. Unless you go out-of-network,

you won’t pay more than this set amount even if you get really sick or seriously injured. This includes any payments you

made against your deductible and pharmacy costs.

Balance billing

This is when the healthcare provider bills you for the difference between what your insurance covers and what the provider

charges. This is not protected by the out-of-pocket max.

Pre-tax

This is money taken out of your paycheck before taxes are taken out. It’s money used to pay for healthcare that you don’t

have to pay taxes on. This means your overall take-home pay increases because the amount you pay in taxes decreases.

25