Page 31 - inside page.cdr

P. 31

ANNUAL REPORT 2018 - 2019

DIRECTORS' REPORT

To,

TheMembers,

The Board of Directors are pleased to present the Company’s Forty Fourth Annual Report together with the Audited

StatementofAccountsfortheyearended31stMarch,2019.

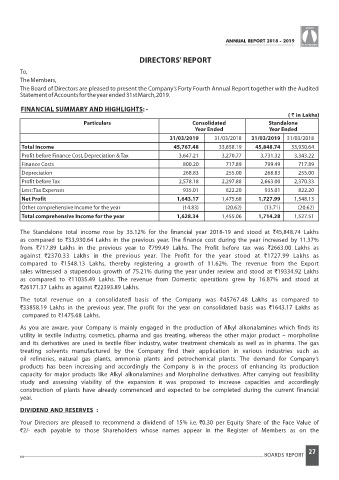

FINANCIAL SUMMARY AND HIGHLIGHTS: -

( ` in akhs)L

Particulars Consolidated Standalone

Year Ended Year Ended

31/03/2019 31/03/2018 31/03/2019 31/03/2018

Total Income 45,767.48 33,858.19 45,848.74 33,930.64

Profit before Finance Cost,Depreciation & Tax 3,647.21 3,270.77 3,731.32 3,343.22

Finance Costs 800.20 717.89 799.49 717.89

Depreciation 268.83 255.00 268.83 255.00

Profit before Tax 2,578.18 2,297.88 2,663.00 2,370.33

Less:Tax Expenses 935.01 822.20 935.01 822.20

Net Profit 1,643.17 1,475.68 1,727.99 1,548.13

Other comprehensive Income for the year (14.83) (20.62) (13.71) (20.62)

Total comprehensive Income for the year 1,628.34 1,455.06 1,714.28 1,527.51

The Standalone total income rose by 35.12% for the financial year 2018-19 and stood at 45,848.74 Lakhs`

as compared to 33,930.64 Lakhs in the previous year. The finance cost during the year increased by 11.37%`

from ` 717.89 Lakhs in the previous year to ` 799.49 Lakhs. The Profit before tax was ` 2663.00 Lakhs as

against ` 2370.33 Lakhs in the previous year. The Profit for the year stood at ` 1727.99 Lakhs as

compared to ` 1548.13 Lakhs, thereby registering a growth of 11.62%. The revenue from the Export

sales witnessed a stupendous growth of 75.21% during the year under review and stood at 19334.92 Lakhs`

as compared to ` 11035.49 Lakhs. The revenue from Domestic operations grew by 16.87% and stood at

`26171.37 Lakhs as against `22393.89 Lakhs.

The total revenue on a consolidated basis of the Company was ` 45767.48 Lakhs as compared to

`33858.19 Lakhs in the previous year. The profit for the year on consolidated basis was `1643.17 Lakhs as

compared to 1475.6 8 Lakhs.

`

As you are aware your Company is mainly engaged in the production of, A lkyl alkonalamines which finds its

utility in textile industry, cosmetics, pharma and gas treating, whereas the other major product – morpholine

and its derivatives are used in textile fiber industry, water treatment chemicals as well as in pharma. The gas

treating solvents manufactured by the Company find their application in various industries such as

oil refineries, natural gas plants, ammonia plants and petrochemical plants The demand for Company’s

.

products has been increasing and accordingly the Company is in the process of enhancing its production

capacity for major products like Alkyl alkonalamines and Morpholine derivatives. After carrying out feasibility

study and assessing viability of the expansion it was proposed to increase capacities and accordingly

construction of plants have already commenced and expected to be completed during the current financial

year.

DIVIDEND AND RESERVES :

Your Directors are pleased to recommend a dividend of 15% i.e. 0.30 per Equity Share of the Face Value of

`

`2/- each payable to those Shareholders whose names appear in the Register of Members as on the

27

BOARDS REPORT