Page 11 - ANTILL DGB

P. 11

Antilliaans Dagblad Maandag 15 april 2019 ADVERTENTIE 11

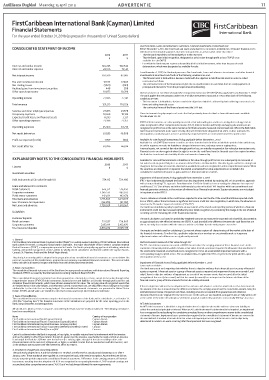

FirstCaribbean International Bank (Cayman) Limited

Financial Statements

For the year ended October 31, 2018 (expressed in thousands of United States dollars)

Due from banks, Loans and advances to customers, Financial investments at amortised cost

CONSOLIDATED STATEMENT OF INCOME ÄÛĮŝÄŶFĮǦÄĜÄŝŶĸ³ŶƆǷĸŬ³Ŷ ƋÄŶÛŝĮĜŶġĎŶġ¸Ŷ?ĮġŤŶġ¸Ŷ¸Ǧġ¨ÄŤŶŹĮŶ¨ƋŤŹĮĜÄŝŤ³ŶĀġ¨đƋ¸Ä¸ŶġĮġÓ¸ÄŝĀǦŹĀǦÄŶÜġġ¨ĀđŶŤŤÄŹŤŶ

ǧĀŹûŶÜǬĸŶĮŝŶ¸ÄŹÄŝĜĀġđÄŶŅǭĜÄġŹŤŶŹûŹŶǧÄŝÄŶġĮŹŶŒƋĮŹÄ¸ŶĀġŶġŶ¨ŹĀǦÄŶĜŝĎÄŹ³ŶĮŹûÄŝŶŹûġŶŹûĮŤÄ²

2018 2017 §Ŷ dûŹŶŹûÄŶ ġĎŶĀġŹÄġ¸Ä¸ŶŹĮŶŤÄđđŶĀĜĜĸĀŹÄđǭŶĮŝŶĀġŶŹûÄŶġÄŝŶŹÄŝĜ

$ $ §Ŷ dûŹŶŹûÄŶ ġĎ³ŶƋŅĮġŶĀġĀŹĀđŶŝĨĮéġĀŹĀĮġ³Ŷ¸ÄŤĀéġŹÄ¸ŶŤŶŹŶÛĀŝŶǦđƋÄŶŹûŝĮƋéûŶŅŝĮÜŹŶĮŝŶđĮŤŤŶŇŗ'sX?ŘňŶĮŝŶŤ

available-for-sale (“AFS”)

§Ŷ 'ĮŝŶǧûĀ¨ûŶŹûÄŶ ġĎŶĜǭŶġĮŹŶŝĨĮǦÄŝŶŤƋŤŹġŹĀđđǭŶđđŶĮÛŶĀŹŤŶĀġĀŹĀđŶĀġǦÄŤŹĜÄġŹ³ŶĮŹûÄŝŶŹûġŶĨƋŤÄŶĮÛŶ¨ŝĸĀŹ

Interest and similar income ŶŶŶŶŶŶŶŶŶĸƆű³ƆäÝŶ ŶŶŶŶŶŶŶŶŶĸǷƆ³ÝäűŶ deterioration, which were designated as available-for-sale.

Interest and similar expense 24,976 ŶŶŶŶŶŶŶŶŶŶŶĸĦ³ÝűĸŶ

'ŝĮĜŶFĮǦÄĜÄŝŶĸ³ŶƆǷĸŬ³ŶŹûÄŶ ġĎŶĮġđǭŶĜÄŤƋŝÄŤŶ ƋÄŶÛŝĮĜŶġĎŤ³Ŷ?ĮġŤŶġ¸Ŷ¸Ǧġ¨ÄŤŶŹĮŶ¨ƋŤŹĮĜÄŝŤŶġ¸ŶĮŹûÄŝŶÜġġ¨ĀđŶ

Net interest income 101,269 ŶŶŶŶŶŶŶŶŶŶŶÌƆ³ĦÌÝŶ investments at amortised cost if both of the following conditions are met:

§Ŷ dûÄŶÜġġ¨ĀđŶŤŤÄŹŶĀŤŶûÄđ¸ŶǧĀŹûĀġŶŶƋŤĀġÄŤŤŶĜĮ¸ÄđŶǧĀŹûŶŹûÄŶĮČĨŹĀǦÄŶŹĮŶûĮđ¸ŶÜġġ¨ĀđŶŤŤÄŹŤŶĀġŶĮŝ¸ÄŝŶŹĮŶ¨ĮđđĨŹ

Fee and Commission income 17,944 17,309 Ŷ ¨ĮġŹŝ¨ŹƋđŶ¨ŤûŶâĮǧŤ

§Ŷ dûÄŶ¨ĮġŹŝ¨ŹƋđŶŹÄŝĜŤŶĮÛŶŹûÄŶÜġġ¨ĀđŶŤŤÄŹŶéĀǦÄŶŝĀŤÄŶĮġŶŤŅĨĀÜĸŶ¸ŹÄŤŶŹĮŶ¨ŤûŶâĮǧŤŶŹûŹŶŝÄŶŤĮđÄđǭŶŅǭĜÄġŹŤŶĮÛ

Net trading losses (1,321) ŶŶŶŶŶŶŶŶŶŶŶŶŶŇƆÝäň

Realised gains from investment securities 448 288 principal and interest (SPPI) on the principal amount outstanding.

Other operating income ŶŶŶŶŶŶŶŶŶŶŶĸǷ³ÌŬÝŶ 10,398

Debt instruments at Fair Value through Other Comprehensive Income (“FVOCI”) (Policy applicable from November 1, 2017)

The Bank applies the new category under IFRS 9 of debt instruments measured at FVOCI when both of the following

Operating income 27,946 27,741 conditions are met:

§Ŷ dûÄŶĀġŤŹŝƋĜÄġŹŶĀŤŶûÄđ¸ŶǧĀŹûĀġŶŶƋŤĀġÄŤŤŶĜĮ¸Äđ³ŶŹûÄŶĮČĨŹĀǦÄŶĮÛŶǧûĀ¨ûŶĀŤŶ¨ûĀÄǦĸŶǭŶĮŹûŶ¨ĮđđĨŹĀġéŶ¨ĮġŹŝ¨ŹƋđŶ¨Ťû

Total revenue ŶŶŶŶŶŶŶŶŶĸƆĦ³ƆĸÝŶ 110,726 Ŷ âĮǧŤŶġ¸ŶŤÄđđĀġéŶÜġġ¨ĀđŶŤŤÄŹŤ

§Ŷ dûÄŶ¨ĮġŹŝ¨ŹƋđŶŹÄŝĜŤŶĮÛŶŹûÄŶÜġġ¨ĀđŶŤŤÄŹŶĜÄÄŹŶŹûÄŶ^XX0ŶŹÄŤŹ

Salaries and other employee expenses 24,813 ŶŶŶŶŶŶŶŶŶŶŶƆŽ³ÝŬÌŶ

Occupancy expenses 10,668 10,134 dûÄŤÄŶĀġŤŹŝƋĜÄġŹŤŶđŝéÄđǭŶ¨ĮĜŅŝĀŤÄŶĮÛŶŤŤÄŹŤŶŹûŹŶû¸ŶŅŝÄǦĀĮƋŤđǭŶÄÄġŶ¨đŤŤĀÜĸŶŤŶÜġġ¨ĀđŶĀġǦÄŤŹĜÄġŹŤŶǦĀđđÄŶ

for-sale under IAS 39.

ǬŅĨŹÄ¸Ŷ¨ŝĸĀŹŶđĮŤŤÄŤŶĮġŶÜġġ¨ĀđŶŤŤÄŹŤ 8,293 ŶŶŶŶŶŶŶŶŶŶŶŶݳŽÝĸŶ

Other operating expenses ŶŶŶŶŶŶŶŶŶŶŶƆĸ³ÝÌűŶ ŶŶŶŶŶŶŶŶŶŶŶƆݳĸÝÝŶ

FVOCI debt instruments are subsequently measured at fair value with gains and losses arising due to changes in fair

value recognised in Other Comprehensive Income (“OCI”). Interest income and foreign exchange gains and losses are

Operating expenses ŶŶŶŶŶŶŶŶŶŶŶűݳŽűǷŶ 64,218 ŝĨĮéġĀŤÄ¸ŶĀġŶŅŝĮÜŹŶĮŝŶđĮŤŤŶĀġŶŹûÄŶŤĜÄŶĜġġÄŝŶŤŶÛĮŝŶÜġġ¨ĀđŶŤŤÄŹŤŶĜÄŤƋŝĸŶŹŶĜĮŝŹĀŤÄ¸Ŷ¨ĮŤŹŋŶtûÄŝÄŶŹûÄŶ ġĎŶûĮđ¸ŤŶ

ĜĮŝÄŶŹûġŶĮġÄŶĀġǦÄŤŹĜÄġŹŶĀġŶŹûÄŶŤĜÄŶŤÄ¨ƋŝĀŹǭ³ŶŹûÄǭŶŝÄŶ¸ÄÄĜĸŶŹĮŶÄŶ¸ĀŤŅĮŤÄ¸ŶĮÛŶĮġŶŶÜŝŤŹÓĀġŶÜŝŤŹÓĮƋŹŶŤĀŤŋŶKġŶ

Net result before tax ŶŶŶŶŶŶŶŶŶŶŶűŽ³ÌÝÝŶ ŶŶŶŶŶŶŶŶŶŶäű³ÝǷÌŶ ¸ÄŝĨĮéġĀŹĀĮġ³Ŷ¨ƋĜƋđŹĀǦÄŶéĀġŤŶĮŝŶđĮŤŤÄŤŶŅŝÄǦĀĮƋŤđǭŶŝĨĮéġĀŤÄ¸ŶĀġŶK 0ŶŝÄŶŝĨđŤŤĀÜĸŶÛŝĮĜŶK 0ŶŹĮŶŅŝĮÜŹŶĮŝŶđĮŤŤŋ

XŝĮÜŹŶŹǬŶÄǬŅÄġŤÄŵҨŝĸĀŹň ŶŶŶŶŶŶŶŶŶŶŶŶĸ³ĦÝĦŶ (106) ǥĀđđÄÿÛĮŜÿţđÄŵÜġġ¨ĀđŵĀġǥÄţŸĜÄġŸţŵŇXĮđĀ¨ǬŵŅŅđĀ¨đÄŵÄÛĮŜÄŵFĮǥÄĜÄŜŵĸ³ŵƅǶĸūň

ǦĀđđÄÿÛĮŝÿŤđÄŶŇŗ '^ŘňŶĀġǦÄŤŹĜÄġŹŶŤÄ¨ƋŝĀŹĀÄŤŶŝÄŶŹûĮŤÄŶĀġŹÄġ¸Ä¸ŶŹĮŶÄŶûÄđ¸ŶÛĮŝŶġŶĀġ¸ÄÜġĀŹÄŶŅÄŝĀĮ¸ŶĮÛŶŹĀĜijŶǧûĀ¨ûŶĜǭŶ

Net result after tax 61,896 46,614 be sold in response to needs for liquidity or changes in interest rates, exchange rates or equity prices.

'Āġġ¨ĀđŶŤŤÄŹŤ³ŶġĮŹŶ¨ŝŝĀĸŶŹŶÛĀŝŶǦđƋÄŶŹûŝĮƋéûŶŅŝĮÜŹŶĮŝŶđĮŤŤ³ŶŝÄŶĀġĀŹĀđđǭŶŝĨĮéġĀŤÄ¸ŶŹŶÛĀŝŶǦđƋÄŶŅđƋŤŶŹŝġŤ¨ŹĀĮġŶ¨ĮŤŹŤŋŶ

'Āġġ¨ĀđŶŤŤÄŹŤŶŝÄŶ¸ÄŝĨĮéġĀŤÄ¸ŶǧûÄġŶŹûÄŶŝĀéûŹŶŹĮŶŝĨÄĀǦÄŶŹûÄŶ¨ŤûŶâĮǧŤŶÛŝĮĜŶŹûÄŶÜġġ¨ĀđŶŤŤÄŹŤŶûŤŶÄǬŅĀŝĸŶĮŝŶǧûÄŝÄŶ

the Bank has transferred substantially all risks and rewards of ownership.

EXPLANATORY NOTES TO THE CONSOLIDATED FINANCIAL HIGHLIGHTS

ǦĀđđÄÿÛĮŝÿŤđÄŶġ¸ŶÜġġ¨ĀđŶŤŤÄŹŤŶĮŝŶđĀĀđĀŹĀÄŤŶŹŶÛĀŝŶǦđƋÄŶŹûŝĮƋéûŶŅŝĮÜŹŶĮŝŶđĮŤŤŶŝÄŶŤƋŤÄŒƋÄġŹđǭŶŝÄÿĜÄŤƋŝĸŶŹŶ

ÛĀŝŶǦđƋÄŶŤÄ¸ŶĮġŶŒƋĮŹÄ¸ŶĀ¸ŶŅŝĀ¨ÄŤŶĮŝŶĜĮƋġŹŤŶ¸ÄŝĀǦĸŶÛŝĮĜŶ¨ŤûŶâĮǧŶĜĮ¸ÄđŤŋŶhġŝÄđĀŤÄ¸ŶéĀġŤŶġ¸ŶđĮŤŤÄŤŶŝĀŤĀġéŶÛŝĮĜŶ

2018 2017

I. Assets $ $ ¨ûġéÄŤŶĀġŶŹûÄŶÛĀŝŶǦđƋÄŶĮÛŶŤÄ¨ƋŝĀŹĀÄŤŶ¨đŤŤĀÜĸŶŤŶǦĀđđÄÿÛĮŝÿŤđÄŶŝÄŶŝĨĮéġĀŤÄ¸ŶĀġŶĮŹûÄŝŶ¨ĮĜŅŝÄûÄġŤĀǦÄŶĀġ¨ĮĜÄŋŶtûÄġŶ

the securities are disposed of or impaired, the related accumulated fair value adjustments are included in the

consolidated statement of income as gains and losses from investment securities.

Investment securities

0ĜŅĀŜĜÄġŸŵĮÛŵÜġġ¨ĀđŵţţÄŸţŵŇXĮđĀ¨ǬŵŅŅđĀ¨đÄŵÛŜĮĜŵFĮǥÄĜÄŜŵĸ³ŵƅǶĸūň

Debt instruments at fair value through OCI 724,112 724,480

IFRS 9 has fundamentally changed the Bank’s loan loss impairment method by replacing IAS 39’s incurred loss approach

with a forward-looking ECL approach. From November 1 2017, the Bank has been recording the allowance for expected

Loans and advances to customers ¨ŝĸĀŹŶđĮŤŤÄŤŶŇŗ ?ŘňŶÛĮŝŶđđŶđĮġŤŶġ¸ŶĮŹûÄŝŶ¸ÄŹŶÜġġ¨ĀđŶŤŤÄŹŤŶġĮŹŶûÄđ¸ŶŹŶ'sX?ŶŹĮéÄŹûÄŝŶǧĀŹûŶđĮġŶ¨ĮĜĜĀŹĜÄġŹŤŶġ¸Ŷ

Retail Customers 626,371 Ýĸű³ĦÝǷ Üġġ¨ĀđŶéƋŝġŹÄÄŶ¨ĮġŹŝ¨ŹŤ³ŶĀġŶŹûĀŤŶŤÄ¨ŹĀĮġŶđđŶŝÄÛÄŝŝĸŶŹĮŶŤŶřÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŤŚŋŶ ŒƋĀŹǭŶĀġŤŹŝƋĜÄġŹŤŶŝÄŶġĮŹŶŤƋČĨŹŶ

Corporate customers ĸ³ǷǷŬ³ÝĸƆ 962,073 to impairment under IFRS 9.

Public sector customers 142,021 162,676

Total loans and advances ŶŶŶŶŶŶĸ³ŬŬݳĦǷäŶ 1,641,699 The ECL allowance is based on the credit losses expected to arise over the life of the asset (the lifetime expected credit

Less: Provisions for impairment ŶŶŶŶŶŶŶŶŶŇŽű³ŽŬÝň (31,132) đĮŤŤŶĮŝŶ?d ?ň³ŶƋġđÄŤŤŶŹûÄŝÄŶûŤŶÄÄġŶġĮŶŤĀéġĀܨġŹŶĀġ¨ŝÄŤÄŶĀġŶ¨ŝĸĀŹŶŝĀŤĎŶŤĀġ¨ÄŶĮŝĀéĀġŹĀĮġ³ŶĀġŶǧûĀ¨ûŶ¨ŤÄ³ŶŹûÄŶđđĮǧġ¨ÄŶĀŤŶ

based on the 12 months’ expected credit loss (“12mECL”).

Net Loans and advances ŶŶŶŶŶŶĸ³ŬŽĦ³ÝƆĦŶ ŶŶŶŶŶŶĸ³űĸǷ³ÝűŬŶ

dûÄŶ ġĎŶûŤŶÄŤŹđĀŤûĸŶŶŅĮđĀ¨ǭŶŹĮŶŅÄŝÛĮŝĜŶġŶŤŤÄŤŤĜÄġŹ³ŶŹŶŹûÄŶÄġ¸ŶĮÛŶĨûŶŝÄŅĮŝŹĀġéŶŅÄŝĀĮ¸³ŶĮÛŶǧûÄŹûÄŝŶŶÜġġ¨ĀđŶ

ĀġŤŹŝƋĜÄġŹŚŤŶ¨ŝĸĀŹŶŝĀŤĎŶûŤŶĀġ¨ŝčĸŶŤĀéġĀܨġŹđǭŶŤĀġ¨ÄŶĀġĀŹĀđŶŝĨĮéġĀŹĀĮġ³ŶǭŶ¨ĮġŤĀ¸ÄŝĀġéŶŹûÄŶ¨ûġéÄŶĀġŶŹûÄŶŝĀŤĎŶĮÛŶ¸ÄÛƋđŹŶ

II. Liabilities

Į¨¨ƋŝŝĀġéŶĮǦÄŝŶŹûÄŶŝÄĜĀġĀġéŶđĀÛÄŶĮÛŶŹûÄŶÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŋŶ

Customer deposits The Bank calculates ECLs based on probability-weighted scenarios to measure the expected cash shortfalls, discounted at

Retail customers ŬƆŽ³ÝÝŬ ŬŽű³ÌǷÝ ġŶŅŅŝĮǬĀĜŹĀĮġŶŹĮŶŹûÄŶÄÛÛĨŹĀǦÄŶĀġŹÄŝÄŤŹŶŝŹÄŶŇŗ 0ZŘňŋŶ Ŷ¨ŤûŶŤûĮŝŹÛđđŶĀŤŶŹûÄŶ¸ĀÛÛÄŝÄġ¨ÄŶÄŹǧÄÄġŶŹûÄŶ¨ŤûŶâĮǧŤŶŹûŹŶŝÄŶ

Corporate customers ŶŶŶŶŶŶƆ³ĸÝŽ³ĸĸĦŶ 2,192,670 ¸ƋÄŶŹĮŶġŶÄġŹĀŹǭŶĀġŶ¨¨Įŝ¸ġ¨ÄŶǧĀŹûŶŹûÄŶ¨ĮġŹŝ¨ŹŶġ¸ŶŹûÄŶ¨ŤûŶâĮǧŤŶŹûŹŶŹûÄŶÄġŹĀŹǭŶÄǬŅĨŹŤŶŹĮŶŝĨÄĀǦÄŋ

Total customer deposits 2,876,676 ŶŶŶŶŶŶƆ³ĦƆĦ³äŬÝŶ

The inputs and models used for calculating ECLs may not always capture all characteristics of the market at the date of

ŹûÄŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŋŶdĮŶŝÄâĨŹŶŹûĀŤ³ŶŒƋđĀŹŹĀǦÄŶ¸ČƋŤŹĜÄġŹŤŶĮŝŶĮǦÄŝđǭŤŶŝÄŶĮ¨¨ŤĀĮġđđǭŶĜ¸ÄŶŤŶŹÄĜŅĮŝŝǭŶ

¸ČƋŤŹĜÄġŹŤŶǧûÄġŶŤƋ¨ûŶ¸ĀÛÛÄŝÄġ¨ÄŤŶŝÄŶŤĀéġĀܨġŹđǭŶĜŹÄŝĀđŋŶ

1. General

FirstCaribbean International Bank (Cayman) Limited (“Bank”) is a wholly owned subsidiary of FirstCaribbean International Debt instruments measured at fair value through OCI

Bank Limited (“Parent”), a company incorporated in Barbados. The major shareholder of the Parent is Canadian Imperial dûÄŶ ?ŤŶÛĮŝŶ¸ÄŹŶĀġŤŹŝƋĜÄġŹŤŶĜÄŤƋŝĸŶŹŶ'sK 0Ŷ¸ĮŶġĮŹŶŝĸƋ¨ÄŶŹûÄŶ¨ŝŝǭĀġéŶĜĮƋġŹŶĮÛŶŹûÄŤÄŶÜġġ¨ĀđŶŤŤÄŹŤŶĀġŶŹûÄŶ

Bank of Commerce (“CIBC”), a company incorporated in Canada. The Bank is principally engaged in retail banking, wholesale ŤŹŹÄĜÄġŹŶĮÛŶÜġġ¨ĀđŶŅĮŤĀŹĀĮġ³ŶǧûĀ¨ûŶŝÄĜĀġŤŶŹŶÛĀŝŶǦđƋÄŋŶ0ġŤŹÄ¸³ŶġŶĜĮƋġŹŶÄŒƋđŶŹĮŶŹûÄŶđđĮǧġ¨ÄŶŹûŹŶǧĮƋđ¸ŶŝĀŤÄŶĀÛŶ

banking, and wealth management services within its wholly owned subsidiaries and branches within the Cayman Islands, the assets were measured at amortised cost is recognised in OCI as an accumulated impairment amount, with a

Curacao, St. Maarten, Aruba and the British Virgin Islands.

¨ĮŝŝÄŤŅĮġ¸ĀġéŶ¨ûŝéÄŶŹĮŶŅŝĮÜŹŶĮŝŶđĮŤŤŋŶdûÄŶ¨¨ƋĜƋđŹÄ¸ŶđĮŤŤŶŝĨĮéġĀŤÄ¸ŶĀġŶK 0ŶĀŤŶŝĨǭ¨đĸŶŹĮŶŹûÄŶŅŝĮÜŹŶġ¸ŶđĮŤŤŶƋŅĮġŶ

dûÄŶŅŝĀġ¨ĀŅđŶ¨¨ĮƋġŹĀġéŶŅĮđĀ¨ĀÄŤŶ¸ĮŅŹÄ¸ŶĀġŶŹûÄŶŅŝÄŅŝŹĀĮġŶĮÛŶĮƋŝŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶŝÄŶŤÄŹŶĮƋŹŶÄđĮǧŋŶdûÄŶ derecognition of the assets.

ġĮŹÄŤŶŝÄŶġŶÄǬŹŝ¨ŹŶĮÛŶŹûÄŶ¸ÄŹĀđĸŶġĮŹÄŤŶŅŝÄŅŝĸŶĀġŶĮƋŝŶŤŹŹƋŹĮŝǭŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŋŶŶdûÄŶġĮŹÄŤŶ¸ÄŹĀđĸŶ

below coincide in all material respect with those from which they have been derived. Impairment of Financial Assets (Policy applicable before November 1, 2017)

Loans and receivables

2. Basis of preparation dûÄŶ ġĎŶŤŤÄŤŤÄŤŶŹŶĨûŶŝÄŅĮŝŹĀġéŶ¸ŹÄŶǧûÄŹûÄŝŶŹûÄŝÄŶĀŤŶĮČĨŹĀǦÄŶÄǦĀ¸Äġ¨ÄŶŹûŹŶŶÜġġ¨ĀđŶŤŤÄŹŶĮŝŶéŝĮƋŅŶĮÛŶÜġġ¨ĀđŶ

dûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶĮÛŶŹûÄŶ ġĎŶûǦÄŶÄÄġŶŅŝÄŅŝĸŶĀġŶ¨¨Įŝ¸ġ¨ÄŶǧĀŹûŶ0ġŹÄŝġŹĀĮġđŶ'Āġġ¨ĀđŶZÄŅĮŝŹĀġéŶ ŤŤÄŹŤŶĀŤŶĀĜŅĀŝĸŋŶ ŶÜġġ¨ĀđŶŤŤÄŹŶĮŝŶŶéŝĮƋŅŶĮÛŶÜġġ¨ĀđŶŤŤÄŹŤŶĀŤŶĀĜŅĀŝĸŶġ¸ŶĀĜŅĀŝĜÄġŹŶđĮŤŤÄŤŶŝÄŶĀġ¨ƋŝŝĸŶĀÛ³Ŷġ¸Ŷ

Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

only if, there is objective evidence of impairment as a result of one or more events that occurred after the initial

dûÄŤÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶûǦÄŶÄÄġŶŅŝÄŅŝĸŶĮġŶŶûĀŤŹĮŝĀ¨đŶ¨ĮŤŹŶŤĀŤ³ŶÄǬ¨ÄŅŹŶÛĮŝŶÛĀŝŶǦđƋÄŶŹûŝĮƋéûŶĮŹûÄŝŶ ŝĨĮéġĀŹĀĮġŶĮÛŶŹûÄŶŤŤÄŹŶŇŶđĮŤŤŶÄǦÄġŹňŶġ¸ŶŹûŹŶđĮŤŤŶÄǦÄġŹŶŇĮŝŶÄǦÄġŹŤňŶûŤŶġŶĀĜŅ¨ŹŶĮġŶŹûÄŶÛƋŹƋŝÄŶ¨ŤûŶâĮǧŤŶĮÛŶŹûÄŶ

¨ĮĜŅŝÄûÄġŤĀǦÄŶĀġ¨ĮĜÄŶŇŗ'sK 0ŘňŶ¸ÄŹŶĀġŤŹŝƋĜÄġŹŤ³ŶÜġġ¨ĀđŶŤŤÄŹŤŶġ¸ŶđĀĀđĀŹĀÄŤŶŹŶÛĀŝŶǦđƋÄŶŹûŝĮƋéûŶŅŝĮÜŹŶġ¸ŶđĮŤŤŶġ¸Ŷ Üġġ¨ĀđŶŤŤÄŹŶĮŝŶéŝĮƋŅŶĮÛŶÜġġ¨ĀđŶŤŤÄŹŤŶŹûŹŶ¨ġŶÄŶŝÄđĀđǭŶÄŤŹĀĜŹÄ¸ŋ

¸ÄŝĀǦŹĀǦÄŶÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŤ³ŶǧûĀ¨ûŶûǦÄŶđđŶÄÄġŶĜÄŤƋŝĸŶŹŶÛĀŝŶǦđƋÄŋŶdûÄŶ¨ŝŝǭĀġéŶǦđƋÄŶĮÛŶŝĨĮéġĀŤÄ¸ŶŤŤÄŹŤŶŹûŹŶ

are hedged items in fair value hedges, and otherwise carried at amortised cost, are adjusted to record changes in fair value If there is objective evidence that an impairment loss on loans and advances carried at amortised cost has been incurred,

ŹŹŝĀƋŹđÄŶŶŹĮŶŹûÄŶŝĀŤĎŤŶŹûŹŶŝÄŶÄĀġéŶûĸéĸŋŶdûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶŝÄŶŅŝÄŤÄġŹÄ¸ŶĀġŶhġĀŹÄ¸Ŷ^ŹŹÄŤŶ the amount of the loss is measured as the difference between the carrying amount and the recoverable amount, being the

Dollars (“USD”), and all values are rounded to the nearest thousand except where indicated otherwise. ÄŤŹĀĜŹÄ¸ŶŅŝÄŤÄġŹŶǦđƋÄŶĮÛŶÄǬŅĨŹÄ¸Ŷ¨ŤûŶâĮǧŤ³ŶĀġ¨đƋ¸ĀġéŶĜĮƋġŹŤŶŝĨĮǦÄŝđÄŶÛŝĮĜŶéƋŝġŹÄÄŤŶġ¸Ŷ¨ĮđđŹÄŝđ³Ŷ

3. Basis of Consolidation ¸ĀŤ¨ĮƋġŹÄ¸ŶŤÄ¸ŶĮġŶŹûÄŶĮŝĀéĀġđŶÄÛÛĨŹĀǦÄŶĀġŹÄŝÄŤŹŶŝŹÄŋŶ ŝĸĀŹŶ¨ŝ¸ŤŶŝÄŶġĮŹŶ¨đŤŤĀÜĸŶŤŶĀĜŅĀŝĸŶġ¸ŶŝÄŶÛƋđđǭŶǧŝĀŹŹÄġŶĮÛÛŶ

dûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶ¨ĮĜŅŝĀŤÄŶŹûÄŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶĮÛŶŹûÄŶ ġĎŶġ¸ŶĀŹŤŶŤƋŤĀ¸ĀŝĀÄŤŶŤŶŹŶK¨ŹĮÄŝŶŽĸ³Ŷ at the earlier of the notice of bankruptcy, settlement, proposal or when the payment is contractually 180 days in arrears.

ƆǷĸÌŶŇŹûÄŶŗŝÄŅĮŝŹĀġéŶ¸ŹÄŘňŋŶdûÄŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶĮÛŶŹûÄŶŤƋŤĀ¸ĀŝĀÄŤŶŝÄŶŅŝÄŅŝĸŶÛĮŝŶŹûÄŶŤĜÄŶŝÄŅĮŝŹĀġéŶǭÄŝŶŤŶŹûÄŶ

Bank, using consistent accounting policies. AFS debt instruments

ġŶ '^Ŷ¸ÄŹŶĀġŤŹŝƋĜÄġŹŶĀŤŶĀ¸ÄġŹĀÜĸŶŤŶĀĜŅĀŝĸŶǧûÄġŶŹûÄŝÄŶĀŤŶĮČĨŹĀǦÄŶĮŤÄŝǦđÄŶÄǦĀ¸Äġ¨ÄŶĮƋŹŶĮƋŝŶĀġĀđĀŹǭŶŹĮŶ

All subsidiaries, which are those companies controlled by the Bank, have been fully consolidated. The following subsidiaries collect the contractual principal or interest. When an AFS debt instrument is determined to be impaired, an impairment

have been consolidated:

loss is recognised by reclassifying the cumulative unrealised losses in other comprehensive income to the consolidated

statement of income. Impairment losses previously recognised in the consolidated statement of income are reversed in

Name Country of Incorporation

FirstCaribbean International Bank (Cayman) Limited Cayman Islands the consolidated statement of income if the fair value subsequently increases and the increase can be objectively

FirstCaribbean International Finance Corporation (Cayman) Limited Cayman Islands determined to relate to an event occurring after the impairment loss was recognised.

FirstCaribbean International (Cayman) Nominees Company Limited Cayman Islands

FirstCaribbean International Finance Corporation (Netherland Antilles) Limited Curacao

FirstCaribbean International Bank (Curacao) N.V. Curacao

Control is achieved when the Bank is exposed, or has rights, to variable returns from its involvement with the investee

ġ¸ŶûŤŶŹûÄŶĀđĀŹǭŶŹĮŶÛÛĨŹŶŹûĮŤÄŶŝÄŹƋŝġŤŶŹûŝĮƋéûŶĀŹŤŶŅĮǧÄŝŶĮǦÄŝŶŹûÄŶĀġǦÄŤŹÄÄŋŶ^ŅĨĀܨđđǭ³ŶŹûÄŶ ġĎŶ¨ĮġŹŝĮđŤŶġŶĀġǦÄŤŹÄÄŶ

if and only if the Bank has: 1) Power over the investee (i.e. existing rights that give it the current ability to direct the

relevant activities of the investee); 2) Exposure, or rights, to variable returns from its involvement with the investee; and

3) The ability to use its power over the investee to affect its returns.

äŋŶ ÄŤ¨ŝĀŅŹĀĮġŶĮÛŶŤĀéġĀܨġŹŶ¨¨ĮƋġŹĀġéŶŅĮđĀ¨ĀÄŤ

The Bank early adopted IFRS 9 and the related IFRS 7R which are effective for annual periods beginning on or after 1

January 2018. These standards were applied on a retrospective basis, with certain exceptions. As permitted, we did not

ŝÄŤŹŹÄŶĮƋŝŶŅŝĀĮŝŶŅÄŝĀĮ¸Ŷ¨ĮĜŅŝŹĀǦÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŋŶ ĀÛÛÄŝÄġ¨ÄŤŶĀġŶŹûÄŶ¨ŝŝǭĀġéŶĜĮƋġŹŤŶĮÛŶÜġġ¨ĀđŶ

instruments resulting from the adoption of IFRS 9 are recognised in our opening November 1, 2017 retained earnings and

accumulated other comprehensive income (“AOCI”) as if we had always followed the new requirements.