Page 19 - ANTILL DGB

P. 19

19

has improved and the financial asset has been reclassified from Stage 3. - Stage 3: Financial assets considered credit- impaired and the Group records an allowance for these Lifetime ECLs. Calculation of Expected credit losses The key elements of the ECL calculations are as fol

basic lending arrangement i.e. interest includes only consideration for the time value of money, credit risk, other basic lending risks and a profit margin that is consistent with a basic lending arrangement. Where the contractual terms introduce exposure to risk or volatility that

ADVERTENTIE Based on these factors, the Group classifies its debt instruments into one of the following two measurement categories: - Amortized cost: Assets that are held for collection of contractual cash flows where those cash flows represent solely payments of principal and interest (‘

Donderdag 18 april 2019 Explanatory notes to the consolidated financial highlights as at December 31 2018 9 as per January 1, 2018 led to a remeasurement of the credit loss provision (increase) on loans and advances to customers of NAF 33,120, on investment securities of NAF 1,256, on deposit

Antilliaans Dagblad A. ACCOUNTING POLICIES 1. GENERAL The principal accounting policies adopted in the preparation of the Consolidated Financial Highlights of Maduro & Curiel’s Bank N.V . and its subsidiaries (the ‘Group’) are set out below. These explanatory notes are an extract of the d

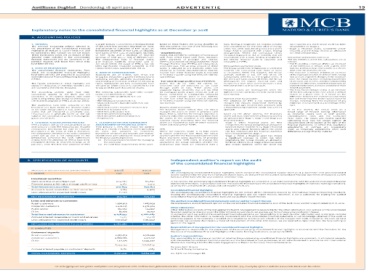

Donderdag 18 april 2019 Consolidated income statement of Maduro & Curiel’s Bank N.V . and its subsidiaries for the year ending December 31, 2018 2017 2018 310,815 313,956 21,403 16,157 289,412 297 ,799 214,563 228,655 80,899 89,225 133,664 139,430 50,410 53

Antilliaans Dagblad (All amounts are expressed in thousands of Antillean Guilders) Interest income Interest expense Net interest income Fee and commission income Fee and commission expenses Net fee and commission income Income from foreign exchange transactions Operating income Salaries and ot

Consolidated balance sheet of Maduro & Curiel’s Bank N.V . and its subsidiaries as at December 31, 2018 (All amounts are expressed in thousands of Antillean Guilders) Cash and due from banks Investment securities Loans and advances to customers Bank premises and equipment Customers' liabil

ADVERTENTIE 2017 2018 2,770,277 2,608,413 625,230 914,777 4,136,191 4,160,380 177 ,531 189,586 6,769 1,490 2,416 6,675 49,389 40,638 7 ,767 ,803 7 ,921,959 6,684,538 6,751,441 22,355 21,717 6,769 1,490 (1,534) 6,910 28,546 20,899

Consolidated Financial ASSETS Highlights Provisions Equity • Per 1 januari 2018 heeft onze Groep IFRS 9 toegepast. Deze nieuwe Standaard zorgt voor een fundamentele wijziging in de wijze waarop bijzondere waardeverminderingen van vorderingen door de Groep wordt bepaald omdat he

18 IFRS 9 IFRS 9.