Page 86 - ARUBA BANK

P. 86

10 ADVERTENTIE Antilliaans Dagblad Dinsdag 4 juni 2019

Consolidated

Financial

Highlights

ȴȦ )*(*2'*7 ȶȉȦȁ

Management report increase in its loans and advances from HYI XS XLI IǺ IGXW SJ .+7 4XLIV STIVEXMRK expect to adequately manage the rapid growth

ANG 348 million to ANG 388 million, while its expenses increased from ANG 6.0 million to SJ :MHERSZE 'ERO ;I FIPMIZI ǻ VQP] XLEX SYV

ECONOMIC SITUATION cash & due from banks decreased from ANG ANG 6.2 million. Personnel expenses increased commitment to provide high quality service

According to the Central Bureau of Statistics 92 million to ANG 73 million. from ANG 8.2 million to ANG 8.9 million as a and personal attention in commercial banking,

the Curacao economy is experiencing a On the liability side of the Balance Sheet, the consequence of movements in personnel. mortgages, international transactions,

prolonged recession with an economic increase in assets was accompanied by an 8LI GYQYPEXMZI IǺ IGX SJ XLIWI HIZIPSTQIRXW e-commerce and bond/loan agency will

contraction since 2016 (-1%), 2017 (-1.7%) and increase of funds entrusted from ANG 376 resulted in a decrease in operating expenses enable Vidanova Bank to continue to prosper.

2018 (-1.6%). While the CBCS projects some million to ANG 417 million as the over-liquid- from ANG 19.3 million to ANG 16.8 million. In order to adopt to new emerging technologies,

growth in 2019 this is based on the underlying ity was reduced. Shareholders’ equity 8LI VIWYPXMRK STIVEXMRK TVSǻ X MW &3, QMPPMSR Vidanova Bank has initiated the process of

EWWYQTXMSR XLEX XLI VIǻ RIV] [MPP GSRXMRYI XS decreased from ANG 80 million to ANG 79 (2017: ANG 1.4 million). Taking into account the actively investing in this area. Digital

operate, albeit in a limited way (paying the million as a consequence of the increase in TVSǻ X XE\ SJ &3, QMPPMSR XLI RIX TVSǻ X MW technologies and services will be one of our

salaries). This assumption is a very tenuous the regulatory reserve and a decrease in the ANG 4.2 million. (2017: ANG 1.1 million). focal points for the near future. The introduction

SRI EW MX MW YRGIVXEMR JSV LS[ PSRK XLI VIǻ RIV] retained earnings due to the implementation of our mobile banking application is not far

will continue to pay salaries and if and when of the IFRS 9 accounting standard. OUTLOOK away. Further digitalization will follow shortly.

a new operator will be found. In view of the Venezuelan developments and We are convinced that our strategy will further

CONSOLIDATED INCOME STATEMENT their repercussions on our economy it is unlikely FIRIǻ X SYV GPMIRXW WXEǺ ERH SYV WLEVILSPHIV

On the positive side 2018 was the best year Interest income increased with ANG 0.4 million that Curacao will see economic growth in ;I SRGI QSVI [ERX XS XLERO SYV GPMIRXW WXEǺ

ever for Curacao tourism (both stay over and while interest expenses decreased with ANG 2019. Whether PdVSA will continue to pay the and shareholder for making it possible to

cruise). Another big challenge facing the 0.2 million. The cumulative effect of these salaries to the ISLA personnel till the end of continue to provide them with high quality

monetary union (Curaçao and Sint Maarten) developments resulted in an ANG 0.6 million 2019 is uncertain. Whether a serious partner and personal attention.

MW E LMKL HIǻ GMX SR XLI GYVVIRX EGGSYRX SJ XLI increase in interest margin to ANG 16 million. will be found to operate let alone modernize

balance of payments. While the deficit for Net fee & commission income increased from XLI VIǻ RIV] ERH KYEVERXII MXW PSRK XIVQ WYVZMZEP Curaçao, May 31, 2019

2017 was ANG 1.1 Billion the estimates for 2018 ANG 2.4 million to ANG 3.0 million. is also uncertain at this moment. On the other

is ANG 1.6 Billion and 2019 ANG 1.8 Billion. Total operating income increased from ANG hand the tourism sector is looking very Managing Board of Directors of Vidanova

20.6 million to ANG 22.2 million. promising with many large and smaller projects Bank N.V.:

CONSOLIDATED BALANCE SHEET In 2018 the net impairment gain on loans and opening soon, in construction or in operation.

During 2018, Vidanova Bank realized an advances of ANG 1.2 million was primarily )IWTMXI XLI HMǽ GYPX IGSRSQMG WMXYEXMSR [I L. Rigaud & R. de Lanoy

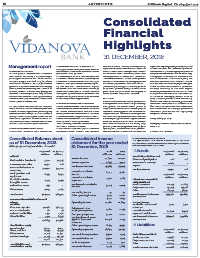

Consolitated Balance sheet ŅĹŸŅĬĜÚ±ƋåÚ FĹÏŅĵå B. SPECIFICATION OF ACCOUNTS

The specification of accounts is an extract of the most

±Ÿ Ņü Ƒŏ %åÏåĵÆåųØ Ɨljŏî ŸƋ±ƋåĵåĹƋ üŅų ƋĘå Ƽå±ų åĹÚåÚ important accounts derived from the statutory consolidated

(After proposed appropriation of results) Ƒŏ %åÏåĵÆåųØ Ɨljŏî ǻ RERGMEP WXEXIQIRXW SJ XLI 'ERO

12.31.2018 12.31.2017 2018 2017 I Assets 12.31.2018 12.31.2017

ANG 000 ANG 000 ANG 000 ANG 000 ANG 000 ANG 000

ASSETS INVESTMENT SECURITIES

Interest income 20,678 20,282

Cash and due from banks 73,112 Shares and participations 106 106

Interest expense 4,693 4,877 Investment in Treasury

Investment securities 17,970 106 Papers 17,864 -

Net interest income 15,985 15,405

Loans and advances to

customers 387,928 347,884 Net investments 17,970 106

Fee and commission

Bank premises and 6,934 6,734 income 6,007 12.31.2018 12.31.2017

equipment ANG 000 ANG 000

Fee and commission

Goodwill and other 9,429 9,239 expenses 2,982 2,763 LOANS AND ADVANCES

intangible assets TO CUSTOMERS

Net fee and commission Retail customers 182,243 170,643

Deferred tax assets 934 - 3,025 2,405

income

Corporate customers

Other assets 9,097 8,863 Other 62,874 36,431

Net trading income 41 32

Total assets 505,404 464,741 Total loans and advances 393,362 352,890

Other operating income 3,131 2,802

to customers

ƐØŎƀƖ ƖØíƐĉ

LIABILITIES AND STOCKHOLDER’S

EQUITY Operating income 22,182 20,644 Accrued interest

Liabilities receivable on loans and 3,214

Customer deposits 417,468 376,073 advances

Salaries and other

Due to other banks 162 employee expenses 8,862 8,233 Less: allowance for (8,648)

Deferred tax liabilities 1,298 expected credit losses

Occupancy expenses 3,048 2,820

Other liabilities 7,422

Net impairment losses/ Net loans and advances 387,928 347,884

426,643 384,361 (gain) on loans and (1,230) 2,249 to customers

advances

Stockholder’s equity Other operating expenses FF XĜ±ÆĜĬĜƋĜåŸ

Issued capital 12.31.2018 12.31.2017

Share premium Operating expenses 16,834 19,259 ANG 000 ANG 000

Other reserve 11,703 10,370

cåƋ ųåŸƚĬƋ üųŅĵ ŅŞåų±ƋĜŅĹŸ ĂØƐĉí ŎØƐíĂ CUSTOMER DEPOSITS

Retained earnings 42,123

cåƋ ųåŸƚĬƋ ÆåüŅųå Ƌ±ƻ Retail customers 80,842

ƀíØƀƅŎ íLjØƐíLj

Corporate customers 81,144

5VSǻ X XE\ I\TIRWI 1,173 302 Other 219,847 214,087

Total liabilities and 505,404 464,741

stockholders’ equity Net result after tax 4,175 1,083 Total customer deposits 417,468 376,073