Page 10 - ANTILL DGB

P. 10

ADVERTENTIE Antilliaans Dagblad Maandag 15 april 2019

10

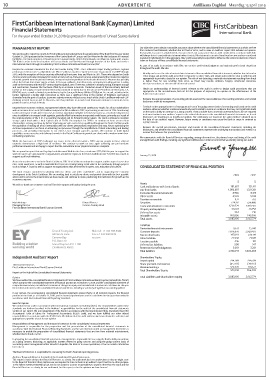

FirstCaribbean International Bank (Cayman) Limited

Financial Statements

For the year ended October 31, 2018 (expressed in thousands of United States dollars)

MANAGEMENT REPORT KƋŝŶĮČĨŹĀǦÄŤŶŝÄŶŹĮŶĮŹĀġŶŝÄŤĮġđÄŶŤŤƋŝġ¨ÄŶĮƋŹŶǧûÄŹûÄŝŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶŤŶŶǧûĮđÄŶŝÄŶÛŝÄÄŶ

from material misstatement, whether due to fraud or error, and to issue an auditors’ report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs

We are pleased to report the results for FirstCaribbean International Bank (Cayman) Limited (“the Bank”) for the year ended will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered

October 31, 2018 pursuant to the Provisions of the Central Bank of Curaçao and Sint Maarten for the Disclosure of Financial

Highlights. The Bank comprises of branches in the Cayman Islands, British Virgin Islands, Sint Maarten, Aruba and Curacao. ĜŹÄŝĀđŶĀÛ³ŶĀġ¸ĀǦĀ¸ƋđđǭŶĮŝŶĀġŶŹûÄŶééŝÄéŹÄ³ŶŹûÄǭŶ¨ĮƋđ¸ŶŝÄŤĮġđǭŶÄŶÄǬŅĨŹÄ¸ŶŹĮŶĀġâƋÄġ¨ÄŶŹûÄŶĨĮġĮĜĀ¨Ŷ¸Ä¨ĀŤĀĮġŤŶĮÛŶƋŤÄŝŤŶ

The Bank is active in the local markets of Curacao, Aruba and Sint Maarten through branches of the Bank, and services ŹĎÄġŶĮġŶŹûÄŶŤĀŤŶĮÛŶŹûÄŤÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŋ

international clients through its subsidiary FirstCaribbean International Bank (Curacao) N.V.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional skepticism

throughout the audit. We also:

Despite the economic rebound in the USA and Canada during 2018 – the Caribbean’s major trading partners, regional

performance did not necessarily follow suit. Most Caribbean markets experienced some expansion in real GDP through

2018, with the exception of those countries affected by Hurricanes Irma and Maria in 2017. Those who depend on South §Ŷ 0¸ÄġŹĀÛǭŶġ¸ŶŤŤÄŤŤŶŹûÄŶŝĀŤĎŤŶĮÛŶĜŹÄŝĀđŶĜĀŤŤŹŹÄĜÄġŹŶĮÛŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤ³ŶǧûÄŹûÄŝŶ¸ƋÄŶŹĮŶÛŝƋ¸ŶĮŝŶ

America and in particular Venezuela for tourist arrivals such as Aruba and Curacao, experienced either modest or negative Ŷ ÄŝŝĮŝ³Ŷ¸ÄŤĀéġŶġ¸ŶŅÄŝÛĮŝĜŶƋ¸ĀŹŶŅŝĮ¨Ä¸ƋŝÄŤŶŝÄŤŅĮġŤĀǦÄŶŹĮŶŹûĮŤÄŶŝĀŤĎŤ³Ŷġ¸ŶĮŹĀġŶƋ¸ĀŹŶÄǦĀ¸Äġ¨ÄŶŹûŹŶĀŤŶŤƋÛܨĀÄġŹŶġ¸

appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud

economic growth over the period. However, increased capital expenditure in hurricane-affected St. Maarten has partially

offset the fall-out from fewer tourist arrivals. In Curaçao, spillovers from Venezuela, an important trading partner is taking is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions,

a toll on the economy with real GDP contracting throughout 2018. There was a decline in manufacturing, transport storage misrepresentations, or the override of internal control.

ġ¸Ŷ¨ĮġŤŹŝƋ¨ŹĀĮġ³ŶûĮǧÄǦÄŝŶŹûĀŤŶûŤŶÄÄġŶĮÛÛŤÄŹŶǭŶġŶĀġ¨ŝÄŤÄŶĀġŶŹĮƋŝĀŤĜŋŶXŝĮ¸Ƌ¨ŹĀĮġŶđÄǦÄđŤŶĮÛŶŹûÄŶ0ŤđŶŝÄÜġÄŝǭŶ¸Ä¨đĀġĸŶ

further as the supply of crude oil from Venezuela continued to shrink due to the seizure of Pertróleos de Venezuela, S.A. §Ŷ KŹĀġŶ ġŶ Ƌġ¸ÄŝŤŹġ¸ĀġéŶ ĮÛŶ ĀġŹÄŝġđŶ ¨ĮġŹŝĮđŶ ŝÄđÄǦġŹŶ ŹĮŶ ŹûÄŶ Ƌ¸ĀŹŶ ĀġŶ Įŝ¸ÄŝŶ ŹĮŶ ¸ÄŤĀéġŶ Ƌ¸ĀŹŶ ŅŝĮ¨Ä¸ƋŝÄŤŶ ŹûŹŶ ŝÄ

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the

ŇX s^ ňŶŤŤÄŹŤŶŤŶǧÄđđŶŤŶđĀĜĀŹÄ¸ŶŤŹÄĜŶ¸ÄđĀǦÄŝĀÄŤŶǭŶŹûÄŶ Ƌŝ¬ĮŶZÄÜġÄŝǭŶhŹĀđĀŹĀÄŤŶŇ ZhňŶŅđġŹŋŶ ŤŶŶŝÄŤƋđŹ³Ŷ¨ŹĀǦĀŹĀÄŤŶĀġŶŹûÄŶ Bank’s internal control.

ûŝĮŝŶ ŝÄéĀŤŹÄŝĸŶ Ŷ ¸ĮƋđÄÿ¸ĀéĀŹŶ ¨ĮġŹŝ¨ŹĀĮġŶ ŤŶŹûÄŝÄŶǧŤŶ Ŷ ŤĀéġĀܨġŹŶ ¸ŝĮŅŶ ĀġŶŹûÄŶ ġƋĜÄŝŶ ĮÛŶ ÛŝÄĀéûŹÄŝŤŶ ġ¸ŶŹġĎÄŝŤŶ

channeled into the port of Curacao. Economic activity remains modest across much of the Dutch Caribbean with real GDP §Ŷ ǦđƋŹÄŶŹûÄŶŅŅŝĮŅŝĀŹÄġÄŤŤŶĮÛŶ¨¨ĮƋġŹĀġéŶŅĮđĀ¨ĀÄŤŶƋŤÄ¸Ŷġ¸ŶŹûÄŶŝÄŤĮġđÄġÄŤŤŶĮÛŶ¨¨ĮƋġŹĀġéŶÄŤŹĀĜŹÄŤŶġ¸ŶŝÄđŹÄ¸

declining in both Curacao and St. Maarten, and sharp declines in arrivals from Venezuela continue to constrain faster disclosures made by management.

growth in tourist arrivals in Aruba.

§Ŷ Įġ¨đƋ¸ÄŶĮġŶŹûÄŶŅŅŝĮŅŝĀŹÄġÄŤŤŶĮÛŶĜġéÄĜÄġŹŚŤŶƋŤÄŶĮÛŶŹûÄŶéĮĀġéŶ¨Įġ¨ÄŝġŶŤĀŤŶĮÛŶ¨¨ĮƋġŹĀġéŶġ¸³ŶŤÄ¸ŶĮġŶŹûÄŶƋ¸ĀŹ

Despite these economic realities, management believes they have delivered satisfactory results for all our stakeholders Ŷ ÄǦĀ¸Äġ¨ÄŶĮŹĀġĸ³ŶǧûÄŹûÄŝŶŶĜŹÄŝĀđŶƋġ¨ÄŝŹĀġŹǭŶÄǬĀŤŹŤŶŝÄđŹÄ¸ŶŹĮŶÄǦÄġŹŤŶĮŝŶ¨Įġ¸ĀŹĀĮġŤŶŹûŹŶĜǭŶ¨ŤŹŶŤĀéġĀܨġŹŶ¸ĮƋŹ

with net income after tax of $61.9 million compared to $46.6 million in 2017, representing an increase of 33%. Contributing

to the current year results were; increases in revenue, largely due to higher net interest income as a result of rising interest Ŷ on the Bank’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required

ŹĮŶ¸ŝǧŶŹŹÄġŹĀĮġŶĀġŶĮƋŝŶƋ¸ĀŹĮŝŤŚŶŝÄŅĮŝŹŶŹĮŶŹûÄŶŝÄđŹÄ¸Ŷ¸ĀŤ¨đĮŤƋŝÄŤŶĀġŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶĮŝ³ŶĀÛŶŤƋ¨û

rates in addition to increased credit appetite; partially offset by increases in expected credit losses, primarily as a result of

the implementation of the IFRS 9 accounting standard and its forward-looking nature. The Bank continues to maintain disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to

strong capital levels with a Total Capital ratio of 20.2%. The emphasis for 2019 is to continue to focus on our client the date of our auditors’ report. However, future events or conditions may cause the Bank to cease to continue as

a going concern.

relationships, existing and new, by further improving our sales and service capability throughout the Dutch Caribbean with

the aspiration of making all of our interactions with our clients personalized, responsive and easy. Key to optimizing the

¨ƋŤŹĮĜÄŝŶÄǬŅÄŝĀÄġ¨ÄŶĀŤŶĮƋŝŶÛĮ¨ƋŤŶĮġŶÄġûġ¨ĀġéŶĮƋŝŶŅŝĮ¨ÄŤŤÄŤŶŹûŝĮƋéûŶŹûÄŶŤĀĜŅđĀܨŹĀĮġŶĮÛŶ¨đĀÄġŹŶĮġĮŝ¸ĀġéŶġ¸ŶđÄġ¸ĀġéŶ §Ŷ ǦđƋŹÄŶ ŹûÄŶ ĮǦÄŝđđŶ ŅŝÄŤÄġŹŹĀĮġ³Ŷ ŤŹŝƋ¨ŹƋŝÄŶ ġ¸Ŷ ¨ĮġŹÄġŹŶ ĮÛŶ ŹûÄŶ ¨ĮġŤĮđĀ¸ŹÄ¸Ŷ Üġġ¨ĀđŶ ŤŹŹÄĜÄġŹŤ³Ŷ Āġ¨đƋ¸ĀġéŶ ŹûÄ

Ŷ

¸ĀŤ¨đĮŤƋŝÄŤ³Ŷġ¸ŶǧûÄŹûÄŝŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶŝÄŅŝÄŤÄġŹŶŹûÄŶƋġ¸ÄŝđǭĀġéŶŹŝġŤ¨ŹĀĮġŤŶġ¸ŶÄǦÄġŹŤŶĀġŶ

processes, and providing information to our clients faster through paperless options. We continue to build digital

capabilities across our sales and delivery channels in the Dutch Caribbean to provide our clients with a modern omni-chan- manner that achieves fair presentation.

nel banking experience.

We communicate with the Board of Directors regarding, among other matters, the planned scope and timing of the audit

While the hurricanes of 2017 challenged our teams in the affected markets, 2018 saw our people in those affected ġ¸ŶŤĀéġĀܨġŹŶƋ¸ĀŹŶÜġ¸ĀġéŤ³ŶĀġ¨đƋ¸ĀġéŶġǭŶŤĀéġĀܨġŹŶ¸ÄܨĀÄġ¨ĀÄŤŶĀġŶĀġŹÄŝġđŶ¨ĮġŹŝĮđŶŹûŹŶǧÄŶĀ¸ÄġŹĀÛǭŶ¸ƋŝĀġéŶĮƋŝŶƋ¸ĀŹŋ

countries demonstrate a high level of resilience. We continue to work on once again achieving our pre-hurricane

performance levels and are happy to report that the renovations to our physical locales are complete.

tÄŶŝÄŶŅŝĮƋ¸ŶŹĮŶŝÄŅĮŝŹŶŹûŹŶĮƋŝŶâéŤûĀŅŶ¨ûŝĀŹđÄŶÄǦÄġŹŶtđĎŶÛĮŝŶŹûÄŶ ƋŝijŶŝĀŤÄ¸ŶĮǦÄŝŶÀÝƆݳǷǷǷŶŹûĀŤŶǭÄŝŶŹĮŶŤƋŅŅĮŝŹŶŹûÄŶ

work of cancer care and awareness organisations around the region. In the Dutch Caribbean over $33,000 was raised to

support such local initiatives. January 23, 2019

Across the markets we serve in the Dutch Caribbean, CIBC FirstCaribbean continued to support a wide range of causes that

raise social awareness, as well as maintained its focus on creating lasting social value in the community through projects

such as Adopt-A-Cause as well as support to organizations that are involved in sports, arts, education and culture. CONSOLIDATED STATEMENT OF FINANCIAL POSITION

The Bank remains committed to working with our clients and other stakeholders and in supporting the economic

development in the Dutch Caribbean. We are working hard to satisfy our clients and provide them with the best possible 2018 2017

advice and to service the investments we have made, and continue to make, positioning the institution for growth as the

economies improve.

Assets $ $

We wish to thank our customers and staff for their support and loyalty during the year.

Cash and balances with Central Banks 181,687 121,411

Due from banks ĸ³ǷÝǷ³űÌŬ 1,321,361

ÄŝĀǦŹĀǦÄŶÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŤ 8,986 8,173

Other assets ä³ÝǷŽ ݳŬäŽ

_________________________ _________________________

Taxation recoverable 837 ŬűÝ

Mark McIntyre Edward Pietersz Securities 724,112 724,480

Managing Director Curacao Country Head Loans and advances to customers ĸ³ŬŽĦ³ÝƆĦ ĸ³űĸǷ³ÝűŬ

FirstCaribbean International Bank (Cayman) Limited

Property and equipment 31,004 Ɔ̳ŬÝÌ

Deferred tax assets ĦÝä 710

Intangible assets 140,806 140,806

Total assets ŶŽ³ÌÌŽ³ĸǷÝ 3,962,774

Liabilities

ÄŝĀǦŹĀǦÄŶÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŤŶ 9,631 ĸݳÌäĸ

Ernst & Young Ltd. Main tel: +1 345 949 8444 Customer deposits 2,876,676 Ɔ³ĦƆĦ³äŬÝ

62 Forum Lane Fax: +1 345 949 8529 Due to other banks 397,093 436,119

Camana Bay ey.com Other liabilities 22,938 21,061

P.O. Box 510 Taxation payable 246 181

Grand Cayman KY1-1106 Deferred tax liabilities ÝǷÌ 347

CAYMAN ISLANDS ZÄŹĀŝÄĜÄġŹŶÄġÄÜŹŶĮđĀéŹĀĮġŤ 3,001 3,261

Total liabilities 3,310,093 ŶŽ³äǷű³ƆÌÝ

Independent Auditors’ Report Shareholders' Equity

Issued capital 294,789 294,789

Share premium and reserves ŶŶŶŶŶŶŶŶŇäݳŬǷŽň (39,972)

The Board of Directors

FirstCaribbean International Bank (Cayman) Limited Retained earnings 323,926 301,672

Total Shareholders' Equity ÝŬŽ³ǷĸƆ ÝÝű³äÌĦ

Report on the Audit of the Consolidated Financial Statements

Opinion Total Liabilities and Shareholders' Equity Ž³ÌÌŽ³ĸǷÝ 3,962,774

tÄŶûǦÄŶƋ¸ĀŹÄ¸ŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶĮÛŶ'ĀŝŤŹ ŝĀÄġŶ0ġŹÄŝġŹĀĮġđŶ ġĎŶŇ ǭĜġňŶ?ĀĜĀŹÄ¸ŶŇŹûÄŶŗ ġĎŘňŶ

ǧûĀ¨ûŶ¨ĮĜŅŝĀŤÄŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶŤŹŹÄĜÄġŹŶĮÛŶÜġġ¨ĀđŶŅĮŤĀŹĀĮġŶŤŶŹŶK¨ŹĮÄŝŶŽĸ³ŶƆǷĸ̳Ŷġ¸ŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶŤŹŹÄĜÄġŹŶĮÛŶ

¨ĮĜŅŝÄûÄġŤĀǦÄŶĀġ¨ĮĜijŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶŤŹŹÄĜÄġŹŶĮÛŶ¨ûġéÄŤŶĀġŶÄŒƋĀŹǭŶġ¸Ŷ¨ĮġŤĮđĀ¸ŹÄ¸ŶŤŹŹÄĜÄġŹŶĮÛŶ¨ŤûŶâĮǧŤŶÛĮŝŶŹûÄŶǭÄŝŶ

ŹûÄġŶÄġ¸Ä¸³Ŷġ¸ŶġĮŹÄŤŶŹĮŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤ³ŶĀġ¨đƋ¸ĀġéŶŶŤƋĜĜŝǭŶĮÛŶŤĀéġĀܨġŹŶ¨¨ĮƋġŹĀġéŶŅĮđĀ¨ĀÄŤŋ

0ġŶĮƋŝŶĮŅĀġĀĮġ³ŶŹûÄŶ¨¨ĮĜŅġǭĀġéŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶŅŝÄŤÄġŹŶÛĀŝđǭ³ŶĀġŶđđŶĜŹÄŝĀđŶŝÄŤŅĨŹŤ³ŶŹûÄŶÜġġ¨ĀđŶ

ŅĮŤĀŹĀĮġŶĮÛŶŹûÄŶ ġĎŶŤŶŹŶK¨ŹĮÄŝŶŽĸ³ŶƆǷĸ̳Ŷġ¸ŶĀŹŤŶÜġġ¨ĀđŶŅÄŝÛĮŝĜġ¨ÄŶġ¸ŶĀŹŤŶ¨ŤûŶâĮǧŤŶÛĮŝŶŹûÄŶǭÄŝŶŹûÄġŶÄġ¸Ä¸ŶĀġŶ

accordance with International Financial Reporting Standards.

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those

ŤŹġ¸ŝ¸ŤŶŝÄŶÛƋŝŹûÄŝŶ¸ÄŤ¨ŝĀĸŶĀġŶŹûÄŶ Ƌ¸ĀŹĮŝŤŚŶŝÄŤŅĮġŤĀĀđĀŹĀÄŤŶÛĮŝŶŹûÄŶƋ¸ĀŹŶĮÛŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶ

section of our report. We are independent of the Bank in accordance with the International Ethics Standards Board for

¨¨ĮƋġŹġŹŤŚŶ Į¸ÄŶ ĮÛŶ ŹûĀ¨ŤŶ ÛĮŝŶ XŝĮÛÄŤŤĀĮġđŶ ¨¨ĮƋġŹġŹŤŶ Ň0 ^ Ŷ Į¸Äň³Ŷ ġ¸Ŷ ǧÄŶ ûǦÄŶ ÛƋđÜđđĸŶ ĮƋŝŶ ĮŹûÄŝŶ ÄŹûĀ¨đŶ

ŝÄŤŅĮġŤĀĀđĀŹĀÄŤŶĀġŶ¨¨Įŝ¸ġ¨ÄŶǧĀŹûŶŹûÄŶ0 ^ Ŷ Į¸ÄŋŶtÄŶÄđĀÄǦÄŶŹûŹŶŹûÄŶƋ¸ĀŹŶÄǦĀ¸Äġ¨ÄŶǧÄŶûǦÄŶĮŹĀġĸŶĀŤŶŤƋÛܨĀÄġŹŶġ¸Ŷ

appropriate to provide a basis for our opinion.

Responsibilities of Management and the Board of Directors for the Consolidated Financial Statements

EġéÄĜÄġŹŶ ĀŤŶ ŝÄŤŅĮġŤĀđÄŶ ÛĮŝŶ ŹûÄŶ ŅŝÄŅŝŹĀĮġŶ ġ¸Ŷ ÛĀŝŶ ŅŝÄŤÄġŹŹĀĮġŶ ĮÛŶ ŹûÄŶ ¨ĮġŤĮđĀ¸ŹÄ¸Ŷ Üġġ¨ĀđŶ ŤŹŹÄĜÄġŹŤŶ ĀġŶ

accordance with International Financial Reporting Standards, and for such internal control as management determines is

ġĨčŤŝǭŶ ŹĮŶ ÄġđÄŶ ŹûÄŶ ŅŝÄŅŝŹĀĮġŶ ĮÛŶ ¨ĮġŤĮđĀ¸ŹÄ¸Ŷ Üġġ¨ĀđŶ ŤŹŹÄĜÄġŹŤŶ ŹûŹŶ ŝÄŶ ÛŝÄÄŶ ÛŝĮĜŶ ĜŹÄŝĀđŶ ĜĀŤŤŹŹÄĜÄġŹ³Ŷ

whether due to fraud or error.

0ġŶŅŝÄŅŝĀġéŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤ³ŶĜġéÄĜÄġŹŶĀŤŶŝÄŤŅĮġŤĀđÄŶÛĮŝŶŤŤÄŤŤĀġéŶŹûÄŶ ġĎŚŤŶĀđĀŹǭŶŹĮŶ¨ĮġŹĀġƋÄŶ

as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of

accounting unless management either intends to liquidate the Bank or to cease operations, or has no realistic alternative

but to do so.

dûÄŶ Įŝ¸ŶĮÛŶ ĀŝĨŹĮŝŤŶĀŤŶŝÄŤŅĮġŤĀđÄŶÛĮŝŶĮǦÄŝŤÄÄĀġéŶŹûÄŶ ġĎŚŤŶÜġġ¨ĀđŶŝÄŅĮŝŹĀġéŶŅŝĮ¨ÄŤŤŋ

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

This report is made solely to the Board of Directors, as a body. Our audit work has been undertaken so that we might state

to the Board of Directors those matters we are required to state to them in an auditors’ report and for no other purpose.

To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Bank and the

Board of Directors as a body, for our audit work, for this report, or for the opinions we have formed.