Page 3 - Social Security - Beginning to Today

P. 3

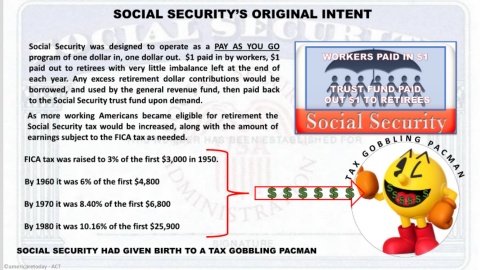

SOCIAL SECURITY’S ORIGINAL INTENT

Social Security was designed to operate as a PAY AS YOU GO

program of one dollar in, one dollar out. $1 paid in by workers, $1

paid out to retirees with very little imbalance left at the end of

each year. Any excess retirement dollar contributions would be

borrowed, and used by the general revenue fund, then paid back

to the Social Security trust fund upon demand.

As more working Americans became eligible for retirement the

Social Security tax would be increased, along with the amount of

earnings subject to the FICA tax as needed.

FICA tax was raised to 3% of the first $3,000 in 1950.

By 1960 it was 6% of the first $4,800

By 1970 it was 8.40% of the first $6,800

By 1980 it was 10.16% of the first $25,900

SOCIAL SECURITY HAD GIVEN BIRTH TO A TAX GOBBLING PACMAN

©americaretoday - ACT