Page 4 - E-NOTE 2-converted

P. 4

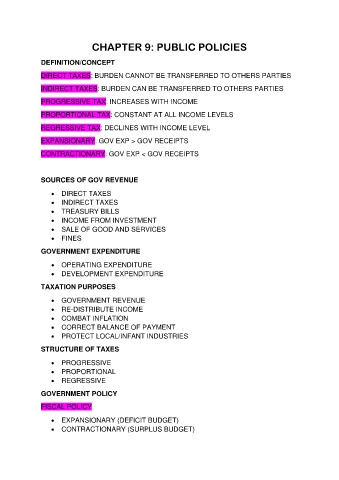

CHAPTER 9: PUBLIC POLICIES

DEFINITION/CONCEPT

DIRECT TAXES: BURDEN CANNOT BE TRANSFERRED TO OTHERS PARTIES

INDIRECT TAXES: BURDEN CAN BE TRANSFERRED TO OTHERS PARTIES

PROGRESSIVE TAX: INCREASES WITH INCOME

PROPORTIONAL TAX: CONSTANT AT ALL INCOME LEVELS

REGRESSIVE TAX: DECLINES WITH INCOME LEVEL

EXPANSIONARY: GOV EXP > GOV RECEIPTS

CONTRACTIONARY: GOV EXP < GOV RECEIPTS

SOURCES OF GOV REVENUE

• DIRECT TAXES

• INDIRECT TAXES

• TREASURY BILLS

• INCOME FROM INVESTMENT

• SALE OF GOOD AND SERVICES

• FINES

GOVERNMENT EXPENDITURE

• OPERATING EXPENDITURE

• DEVELOPMENT EXPENDITURE

TAXATION PURPOSES

• GOVERNMENT REVENUE

• RE-DISTRIBUTE INCOME

• COMBAT INFLATION

• CORRECT BALANCE OF PAYMENT

• PROTECT LOCAL/INFANT INDUSTRIES

STRUCTURE OF TAXES

• PROGRESSIVE

• PROPORTIONAL

• REGRESSIVE

GOVERNMENT POLICY

FISCAL POLICY

• EXPANSIONARY (DEFICIT BUDGET)

• CONTRACTIONARY (SURPLUS BUDGET)