Page 31 - Proof no 3

P. 31

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 31 DECEMBER 2018 (CONTINUED)

5. Investments in Securities (continued)

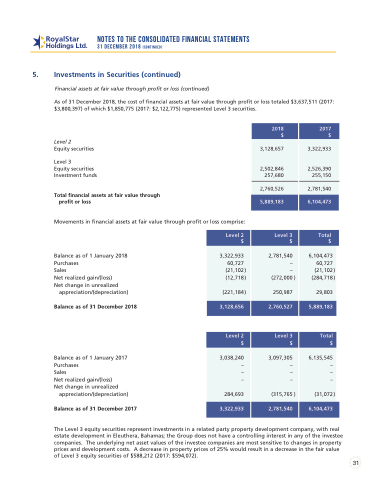

Financial assets at fair value through profit or loss (continued)

As of 31 December 2018, the cost of financial assets at fair value through profit or loss totaled $3,637,511 (2017: $3,800,397) of which $1,850,775 (2017: $2,122,775) represented Level 3 securities.

Level 2

Equity securities

Level 3

Equity securities Investment funds

Total financial assets at fair value through profit or loss

Movements in financial assets at fair value through profit or loss comprise:

Balance as of 1 January 2018 Purchases

Sales

Net realized gain/(loss)

Net change in unrealized appreciation/(depreciation)

Balance as of 31 December 2018

Balance as of 1 January 2017 Purchases

Sales

Net realized gain/(loss)

Net change in unrealized appreciation/(depreciation)

Balance as of 31 December 2017

The Level 3 equity securities represent investments in a related party property development company, with real estate development in Eleuthera, Bahamas; the Group does not have a controlling interest in any of the investee companies. The underlying net asset values of the investee companies are most sensitive to changes in property prices and development costs. A decrease in property prices of 25% would result in a decrease in the fair value of Level 3 equity securities of $588,212 (2017: $594,072).

31

2018 $

2017 $

3,128,657

2,502,846 257,680

3,322,933

2,526,390 255,150

2,760,526

2,781,540

5,889,183

6,104,473

Level 2 $

Level 3 $

Total $

3,322,933 60,727

(21,102 ) (12,718 )

(221,184 )

2,781,540 – –

(272,000 ) 250,987

6,104,473 60,727

(21,102 ) (284,718 )

29,803

3,128,656

2,760,527

5,889,183

Level 2 $

Level 3 $

Total $

3,038,240 – – –

284,693

3,097,305 – – –

(315,765 )

6,135,545 – – –

(31,072 )

3,322,933

2,781,540

6,104,473