Page 33 - Proof no 3

P. 33

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 31 DECEMBER 2018 (CONTINUED)

5. Investments in Securities (continued)

Loans and receivables (continued)

Investments in Bahamas Government registered stocks in the amount of $1 million are placed in a trust and cannot be distributed from the trust without the permission of the insurance regulator in The Bahamas.

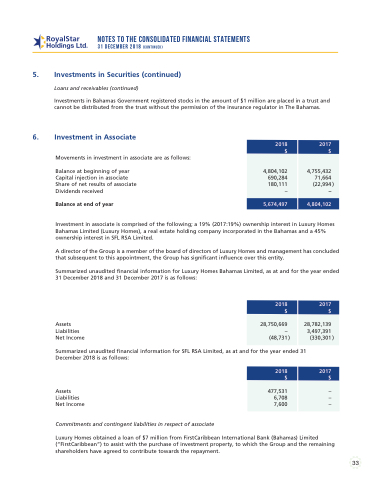

6. Investment in Associate

Movements in investment in associate are as follows:

Balance at beginning of year Capital injection in associate Share of net results of associate Dividends received

Balance at end of year

2018 2017 $$

Investment in associate is comprised of the following; a 19% (2017:19%) ownership interest in Luxury Homes Bahamas Limited (Luxury Homes), a real estate holding company incorporated in the Bahamas and a 45% ownership interest in SFL RSA Limited.

A director of the Group is a member of the board of directors of Luxury Homes and management has concluded that subsequent to this appointment, the Group has significant influence over this entity.

Summarized unaudited financial information for Luxury Homes Bahamas Limited, as at and for the year ended 31 December 2018 and 31 December 2017 is as follows:

4,804,102 690,284 180,111

–

5,674,497

4,755,432 71,664

(22,994 )

–

4,804,102

Assets Liabilities Net Income

28,750,669 –

(48,731 )

Summarized unaudited financial information for SFL RSA Limited, as at and for the year ended 31 December 2018 is as follows:

2018 2017 $$

28,782,139 3,497,391

(330,301 )

2018 $$

477,531 – 6,708 – 7,600 –

2017

Assets Liabilities Net Income

Commitments and contingent liabilities in respect of associate

Luxury Homes obtained a loan of $7 million from FirstCaribbean International Bank (Bahamas) Limited (“FirstCaribbean”) to assist with the purchase of investment property, to which the Group and the remaining shareholders have agreed to contribute towards the repayment.

33