Page 34 - Proof no 3

P. 34

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 31 DECEMBER 2018 (CONTINUED)

6. Investment in Associate (continued)

Commitments and contingent liabilities in respect of associate (continued)

During January 2018, the Directors of Luxury Homes decided to repay the outstanding loan balance due to FirstCaribbean. This required a capital injection by the Group in the amount of $658,525 (2017: $53,431) which represents the Group’s obligation of the outstanding loan balance.

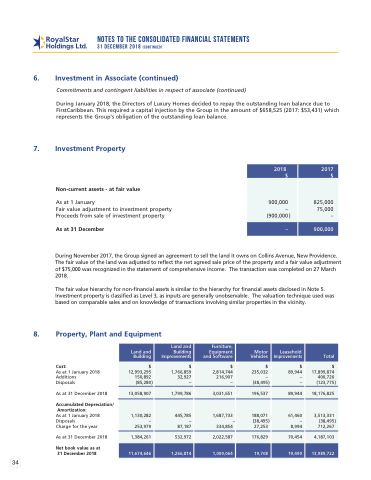

7. Investment Property

2018 $

2017 $

900,000 –

(900,000 )

825,000 75,000 –

–

900,000

$

Non-current assets - at fair value

As at 1 January

Fair value adjustment to investment property Proceeds from sale of investment property

As at 31 December

During November 2017, the Group signed an agreement to sell the land it owns on Collins Avenue, New Providence. The fair value of the land was adjusted to reflect the net agreed sale price of the property and a fair value adjustment of $75,000 was recognized in the statement of comprehensive income. The transaction was completed on 27 March 2018.

The fair value hierarchy for non-financial assets is similar to the hierarchy for financial assets disclosed in Note 5. Investment property is classified as Level 3, as inputs are generally unobservable. The valuation technique used was based on comparable sales and on knowledge of transactions involving similar properties in the vicinity.

Land andBuilding ent

8. Property, Plant and Equipment

Land and

Cost:

As at 1 January 2018 Additions

Disposals

As at 31 December 2018

Accumulated Depreciation/ Amortization:

As at 1 January 2018 Disposals

Charge for the year

As at 31 December 2018

Net book value as at 31 December 2018

Equip

Motor Leasehold

Land and Building

Land and

Building Improvements

Furniture,

Equipment and Software

Motor Vehicles

Leasehold Improvements

Total

$

12,993,295 150,892

(85,280 )

$

1,766,859 32,927 –

$

2,814,744 216,907 –

$

235,032 –

(38,495 )

$

89,944 – –

$

17,899,874 400,726

(123,775 )

13,058,907

1,799,786

3,031,651

196,537

89,944

18,176,825

1,130,282 – 253,979

445,785 – 87,187

1,687,733 –

334,854

188,071 (38,495 )

27,253

61,460 – 8,994

3,513,331 (38,495 )

712,267

1,384,261

532,972

2,022,587

176,829

70,454

4,187,103

11,674,646

1,266,814

1,009,064

19,708

19,490

13,989,722

34