Page 43 - Proof no 3

P. 43

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 31 DECEMBER 2018 (CONTINUED)

17. Risk Management (continued)

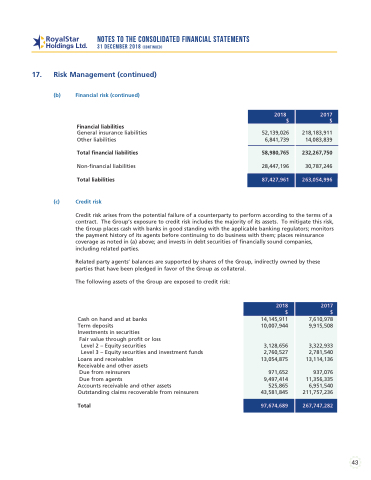

(b) Financial risk (continued)

Financial liabilities

General insurance liabilities Other liabilities

Total financial liabilities

Non-financial liabilities

Total liabilities

(c) Credit risk

2018 2017 $$

The following assets of the Group are exposed to credit risk:

Cash on hand and at banks Term deposits

Investments in securities

Fair value through profit or loss

Level 2 – Equity securities

Level 3 – Equity securities and investment funds

Loans and receivables Receivable and other assets

Due from reinsurers

Due from agents

Accounts receivable and other assets Outstanding claims recoverable from reinsurers

Total

2018 2017 $$

52,139,026 6,841,739

58,980,765

28,447,196

87,427,961

218,183,911 14,083,839

232,267,750

30,787,246

263,054,996

Credit risk arises from the potential failure of a counterparty to perform according to the terms of a contract. The Group’s exposure to credit risk includes the majority of its assets. To mitigate this risk, the Group places cash with banks in good standing with the applicable banking regulators; monitors the payment history of its agents before continuing to do business with them; places reinsurance coverage as noted in (a) above; and invests in debt securities of financially sound companies, including related parties.

Related party agents’ balances are supported by shares of the Group, indirectly owned by these parties that have been pledged in favor of the Group as collateral.

14,145,911 10,007,944

3,128,656

2,760,527 13,054,875

971,652 9,497,414 525,865 43,581,845

97,674,689

7,610,978 9,915,508

3,322,933

2,781,540 13,114,136

937,076 11,356,335 6,951,540 211,757,236

267,747,282

43