Page 45 - Proof no 3

P. 45

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 31 DECEMBER 2018 (CONTINUED)

17. Risk Management (continued)

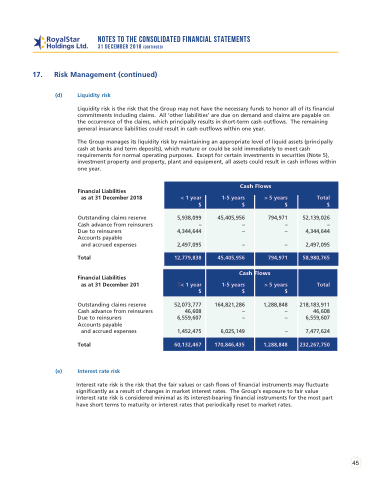

(d) Liquidity risk

Liquidity risk is the risk that the Group may not have the necessary funds to honor all of its financial commitments including claims. All ‘other liabilities’ are due on demand and claims are payable on the occurrence of the claims, which principally results in short-term cash outflows. The remaining general insurance liabilities could result in cash outflows within one year.

The Group manages its liquidity risk by maintaining an appropriate level of liquid assets (principally cash at banks and term deposits), which mature or could be sold immediately to meet cash requirements for normal operating purposes. Except for certain investments in securities (Note 5), investment property and property, plant and equipment, all assets could result in cash inflows within one year.

Financial Liabilities

as at 31 December 2018

Outstanding claims reserve Cash advance from reinsurers Due to reinsurers

Accounts payable

and accrued expenses

Total

Financial Liabilities

as at 31 December 201

Cash Flows

< 1 year 1-5 years > 5 years Total $$$$

5,938,099 – 4,344,644

2,497,095

12,779,838

45,405,956 – –

–

45,405,956

794,971 – –

–

794,971

52,139,026 – 4,344,644

2,497,095

58,980,765

–

7< 1 year

$ $$$

Total

218,183,911 46,608 6,559,607

7,477,624

232,267,750

Outstanding claims reserve Cash advance from reinsurers Due to reinsurers

Accounts payable

and accrued expenses

52,073,777 46,608 6,559,607

1,452,475

164,821,286 1,288,848 – – – –

6,025,149 –

170,846,435 1,288,848

Total 60,132,467

(e) Interest rate risk

Interest rate risk is the risk that the fair values or cash flows of financial instruments may fluctuate significantly as a result of changes in market interest rates. The Group’s exposure to fair value interest rate risk is considered minimal as its interest-bearing financial instruments for the most part have short terms to maturity or interest rates that periodically reset to market rates.

Cash Flows

1-5 years > 5 years

45