Page 28 - The Insurance Times August 2024

P. 28

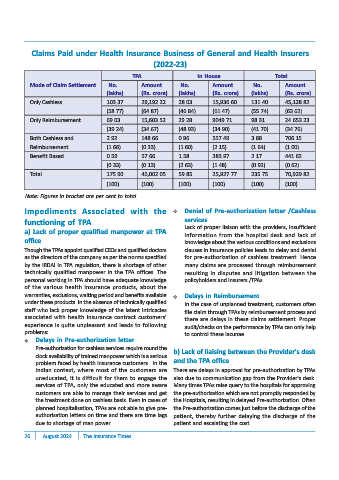

Claims Paid under Health Insurance Business of General and Health Insurers

(2022-23)

TPA In House Total

Mode of Claim Settlement No. Amount No. Amount No. Amount

(lakhs) (Rs. crore) (lakhs) (Rs. crore) (lakhs) (Rs. crore)

Only Cashless 103.37 29,192.22 28.03 15,936.60 131.40 45,128.82

(58.77) (64.87) (46.84) (61.47) (55.74) (63.62)

Only Reimbursement 69.03 15,603.52 29.28 9049.71 98.31 24 653.23

(39.24) (34.67) (48.93) (34.90) (41.70) (34.76)

Both Cashless and 2.92 148.66 0.96 557.49 3.88 706.15

Reimbursement (1.66) (0.33) (1.60) (2.15) (1.64) (1.00)

Benefit Based 0.59 57.66 1.58 383.97 2.17 441.63

(0.33) (0.13) (2.63) (1.48) (0.92) (0.62)

Total 175.90 45,002.05 59.85 25,927.77 235.75 70,929.82

(100) (100) (100) (100) (100) (100)

Note: Figures in bracket are per cent to total.

Impediments Associated with the Denial of Pre-authorization letter /Cashless

functioning of TPA services

Lack of proper liaison with the providers, insufficient

a) Lack of proper qualified manpower at TPA

information from the hospital desk and lack of

office knowledge about the various conditions and exclusions

Though the TPAs appoint qualified CEOs and qualified doctors clauses in insurance policies leads to delay and denial

as the directors of the company as per the norms specified for pre-authorization of cashless treatment. Hence

by the IRDAI in TPA regulation, there is shortage of other many claims are processed through reimbursement

technically qualified manpower in the TPA offices. The resulting in disputes and litigation between the

personal working in TPA should have adequate knowledge policyholders and Insurers /TPAs.

of the various health insurance products, about the

warranties, exclusions, waiting period and benefits available Delays in Reimbursement

under these products. In the absence of technically qualified In the case of unplanned treatment, customers often

staff who lack proper knowledge of the latent intricacies file claim through TPAs by reimbursement process and

associated with health insurance contract customers' there are delays in these claims settlement. Proper

experience is quite unpleasant and leads to following audit/checks on the performance by TPAs can only help

problems: to control these lacunae.

Delays in Pre-authorization letter

Pre-authorization for cashless services require round the b) Lack of liaising between the Provider's desk

clock availability of trained manpower which is a serious

problem faced by health insurance customers. In the and the TPA office

Indian context, where most of the customers are There are delays in approval for pre-authorization by TPAs

uneducated, it is difficult for them to engage the also due to communication gap from the Provider's desk.

services of TPA, only the educated and more aware Many times TPAs raise query to the hospitals for approving

customers are able to manage their services and get the pre-authorization which are not promptly responded by

the treatment done on cashless basis. Even in cases of the Hospitals, resulting in delayed Pre-authorization. Often

planned hospitalisation, TPAs are not able to give pre- the Pre-authorization comes just before the discharge of the

authorisation letters on time and there are time lags patient, thereby further delaying the discharge of the

due to shortage of man power. patient and escalating the cost.

26 August 2024 The Insurance Times