Page 25 - The Insurance Times October 2021

P. 25

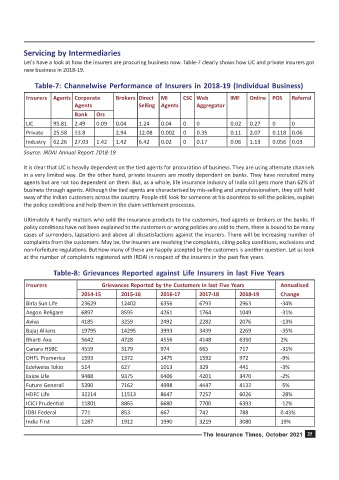

Servicing by Intermediaries

Let's have a look at how the insurers are procuring business now. Table-7 clearly shows how LIC and private insurers got

new business in 2018-19.

Table-7: Channelwise Performance of Insurers in 2018-19 (Individual Business)

Insurers Agents Corporate Brokers Direct MI CSC Web IMF Online POS Referral

Agents Selling Agents Aggregator

Bank Ors

LIC 95.81 2.49 0.09 0.04 1.24 0.04 0 0 0.02 0.27 0 0

Private 25.58 53.8 2.94 12.08 0.002 0 0.35 0.11 2.07 0.118 0.06

Industry 62.26 27.03 1.42 1.42 6.42 0.02 0 0.17 0.06 1.13 0.056 0.03

Source: IRDAI Annual Report 2018-19

It is clear that LIC is heavily dependent on the tied agents for procuration of business. They are using alternate channels

in a very limited way. On the other hand, private insurers are mostly dependent on banks. They have recruited many

agents but are not too dependent on them. But, as a whole, life insurance industry of India still gets more than 62% of

business through agents. Although the tied agents are characterised by mis-selling and unprofessionalism, they still hold

sway of the Indian customers across the country. People still look for someone at his doorsteps to sell the policies, explain

the policy conditions and help them in the claim settlement processes.

Ultimately it hardly matters who sold the insurance products to the customers, tied agents or brokers or the banks. If

policy conditions have not been explained to the customers or wrong policies are sold to them, there is bound to be many

cases of surrenders, lapsations and above all dissatisfactions against the insurers. There will be increasing number of

complaints from the customers. May be, the insurers are resolving the complaints, citing policy conditions, exclusions and

non-forfeiture regulations. But how many of these are happily accepted by the customers is another question. Let us look

at the number of complaints registered with IRDAI in respect of the insurers in the past five years.

Table-8: Grievances Reported against Life Insurers in last Five Years

Insurers Grievances Reported by the Customers in last Five Years Annualised

2014-15 2015-16 2016-17 2017-18 2018-19 Change

Birla Sun Life 23629 12402 6356 6793 2963 -34%

Aegon Religare 6897 8595 4261 1764 1049 -31%

Aviva 4185 3259 2492 2282 2076 -13%

Bajaj Allianz 19795 14295 3993 3439 2269 -35%

Bharti Axa 5642 4728 4556 4148 6350 2%

Canara HSBC 4559 3179 974 665 717 -31%

DHFL Pramerica 1593 1372 1475 1592 972 -9%

Edelweiss Tokio 514 627 1013 329 441 -3%

Exide Life 9488 9375 6406 4201 3470 -2%

Future Generali 5390 7162 4998 4447 4132 -5%

HDFC Life 32214 11513 8647 7257 6026 -28%

ICICI Prudential 11801 8865 6680 7700 6393 -12%

IDBI Federal 771 853 667 742 788 0.43%

India First 1287 1912 1990 3219 3080 19%

The Insurance Times, October 2021 25