Page 51 - Insurance Times September 2021

P. 51

Circular

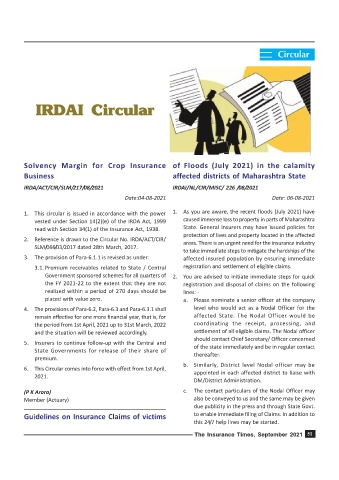

IRDAI Circular

Solvency Margin for Crop Insurance of Floods (July 2021) in the calamity

Business affected districts of Maharashtra State

IRDA/ACT/CIR/SLM/217/08/2021 IRDAI/NL/CIR/MISC/ 226 /08/2021

Date:04-08-2021 Date: 06-08-2021

1. This circular is issued in accordance with the power 1. As you are aware, the recent floods (July 2021) have

vested under Section 14(2)(e) of the IRDA Act, 1999 caused immense loss to property in parts of Maharashtra

read with Section 34(1) of the Insurance Act, 1938. State. General Insurers may have issued policies for

protection of lives and property located in the affected

2. Reference is drawn to the Circular No. IRDA/ACT/CIR/

areas. There is an urgent need for the insurance industry

SLM/066/03/2017 dated 28th March, 2017.

to take immediate steps to mitigate the hardships of the

3. The provision of Para-6.1.1 is revised as under: affected insured population by ensuring immediate

3.1. Premium receivables related to State / Central registration and settlement of eligible claims.

Government sponsored schemes for all quarters of 2. You are advised to initiate immediate steps for quick

the FY 2021-22 to the extent that they are not registration and disposal of claims on the following

realized within a period of 270 days should be lines: -

placed with value zero. a. Please nominate a senior officer at the company

4. The provisions of Para-6.2, Para-6.3 and Para-6.3.1 shall level who would act as a Nodal Officer for the

remain effective for one more financial year, that is, for affected State. The Nodal Officer would be

the period from 1st April, 2021 up to 31st March, 2022 coordinating the receipt, processing, and

and the situation will be reviewed accordingly. settlement of all eligible claims. The Nodal officer

should contact Chief Secretary/ Officer concerned

5. Insurers to continue follow-up with the Central and

State Governments for release of their share of of the state immediately and be in regular contact

thereafter.

premium.

b. Similarly, District level Nodal officer may be

6. This Circular comes into force with effect from 1st April,

appointed in each affected district to liaise with

2021.

DM/District Administration.

(P K Arora) c. The contact particulars of the Nodal Officer may

Member (Actuary) also be conveyed to us and the same may be given

due publicity in the press and through State Govt.

Guidelines on Insurance Claims of victims to enable immediate filing of Claims. In addition to

this 24/7 help lines may be started.

The Insurance Times, September 2021 51