Page 25 - The Insurance Times March 2025

P. 25

the risk of loss of a particular kind, in a specific location or breach of a contractual term where the breach was in no

at a certain time, the insurer will not be able to rely on a way connected to the actual loss.

breach of the term if the non-compliance could not have

increased the risk of the loss that in reality occurred. This is Nature of warranty

according to Section 11(3) of IA Act 2015 (UK), which states,

We have already stated that in insurance law, the term

'The insured satisfies this subsection if it shows that the non-

'warranty' has a different meaning and refers to a major

compliance with the term could not have increased the risk

contract term. Under the current law, the breach of a war-

of the loss which actually occurred in the circumstances in

ranty in an insurance policy suspends the insurance cover

which it occurred' Though this clause is used as a warranty

until the insured remedies the breach.

but the sting is curbed significantly.

It may be noted here that warranties may be implied in

In other words, the interaction between s.10 (breach of

marine insurance only. For example, Section 39 of the Ma-

warranty) and s.11 (terms not relevant to loss) explains that

rine Insurance Act 1906 automatically carries the implied

a breach of a warranty suspends an insurance policy, and

warranty of seaworthiness into every marine insurance

the insurer will not be liable for any claims until the breach

policy. In non-marine insurance, warranties must be ex-

is remedied by the insured. However, if the warranty ap-

pressly worded in the contract.

plies to a loss of a particular kind or at a specific location or

time, section 11 will apply. If the insured can show that the

The time has come to modernise the Indian Insurance Act

breach did not increase the risk of the loss that occurred,

to make it customer-friendly.

they should be able to claim under the policy (as stated in

section 11 (3)) despite the non-compliance with the war- Reference:

ranty. In the case of a warranty or other term intended to

1. Insurance Act 2015: Changes to UK Insurance Law -Com-

reduce the risk of loss of a particular kind, in a specific loca-

parison of Existing and New Regimes- www.cms-

tion or at a certain time, the insurer will not be able to rely

cmck.com

on a breach of the term if the non-compliance could not have

2. Insurance Act 2015 (UK)

increased the risk of the loss that actually occurred.

3. Consumer Insurance (Disclosure and Representations)

A significant relief to customers as the purpose of section Act 2012

.11 is to prevent the insurer from disallowing a claim for 4. Marine Insurance Act 1906

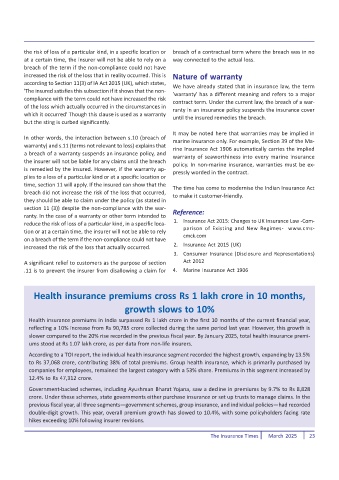

Health insurance premiums cross Rs 1 lakh crore in 10 months,

growth slows to 10%

Health insurance premiums in India surpassed Rs 1 lakh crore in the first 10 months of the current financial year,

reflecting a 10% increase from Rs 90,785 crore collected during the same period last year. However, this growth is

slower compared to the 20% rise recorded in the previous fiscal year. By January 2025, total health insurance premi-

ums stood at Rs 1.07 lakh crore, as per data from non-life insurers.

According to a TOI report, the individual health insurance segment recorded the highest growth, expanding by 13.5%

to Rs 37,068 crore, contributing 38% of total premiums. Group health insurance, which is primarily purchased by

companies for employees, remained the largest category with a 53% share. Premiums in this segment increased by

12.4% to Rs 47,312 crore.

Government-backed schemes, including Ayushman Bharat Yojana, saw a decline in premiums by 9.7% to Rs 8,828

crore. Under these schemes, state governments either purchase insurance or set up trusts to manage claims. In the

previous fiscal year, all three segmentsgovernment schemes, group insurance, and individual policieshad recorded

double-digit growth. This year, overall premium growth has slowed to 10.4%, with some policyholders facing rate

hikes exceeding 10% following insurer revisions.

The Insurance Times March 2025 23