Page 50 - Banking Finance March 2023

P. 50

ARTICLE

Let's come to the present by stopping the past. The popular supply chain and is causing high inflation. The food and

Trickle-Down theory introduced by Liz Trussand energy prices have significantly increased the cost of living.

KwasiKwarteng through Mini Budget has been outrightly The import bills are increasing owing to weakening GBP. The

rejected by the market due to unclear execution plans. The Central Bank is bound to tighten monetary policy resulting

tax cut for rich people has negligible possibility to translate in a high interest rate.

into investment at this juncture and the UK economy is

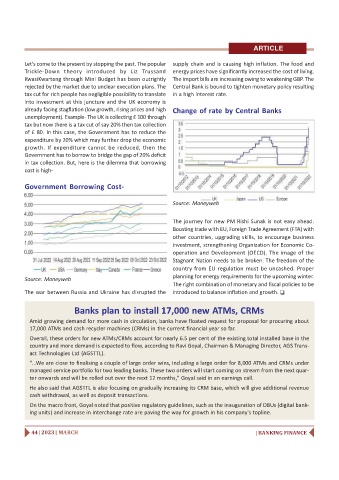

already facing stagflation (low growth, rising prices and high Change of rate by Central Banks

unemployment). Example- The UK is collecting £ 100 through

tax but now there is a tax cut of say 20% then tax collection

of £ 80. In this case, the Government has to reduce the

expenditure by 20% which may further drop the economic

growth. If expenditure cannot be reduced, then the

Government has to borrow to bridge the gap of 20% deficit

in tax collection. But, here is the dilemma that borrowing

cost is high-

Government Borrowing Cost-

Source: Moneyweb

The journey for new PM Rishi Sunak is not easy ahead.

Boosting trade with EU, Foreign Trade Agreement (FTA) with

other countries, upgrading skills, to encourage business

investment, strengthening Organization for Economic Co-

operation and Development (OECD). The image of the

Stagnant Nation needs to be broken. The freedom of the

country from EU regulation must be uncashed. Proper

planning for energy requirements for the upcoming winter.

Source: Moneyweb

The right combination of monetary and fiscal policies to be

The war between Russia and Ukraine has disrupted the introduced to balance inflation and growth.

Banks plan to install 17,000 new ATMs, CRMs

Amid growing demand for more cash in circulation, banks have floated request for proposal for procuring about

17,000 ATMs and cash recycler machines (CRMs) in the current financial year so far.

Overall, these orders for new ATMs/CRMs account for nearly 6.5 per cent of the existing total installed base in the

country and more demand is expected to flow, according to Ravi Goyal, Chairman & Managing Director, AGS Trans-

act Technologies Ltd (AGSTTL).

"...We are close to finalising a couple of large order wins, including a large order for 8,000 ATMs and CRMs under

managed service portfolio for two leading banks. These two orders will start coming on stream from the next quar-

ter onwards and will be rolled out over the next 12 months," Goyal said in an earnings call.

He also said that AGSTTL is also focusing on gradually increasing its CRM base, which will give additional revenue

cash withdrawal, as well as deposit transactions.

On the macro front, Goyal noted that positive regulatory guidelines, such as the inauguration of DBUs (digital bank-

ing units) and increase in interchange rate are paving the way for growth in his company's topline.

44 | 2023 | MARCH | BANKING FINANCE