Page 45 - The Insurance Times December 2024

P. 45

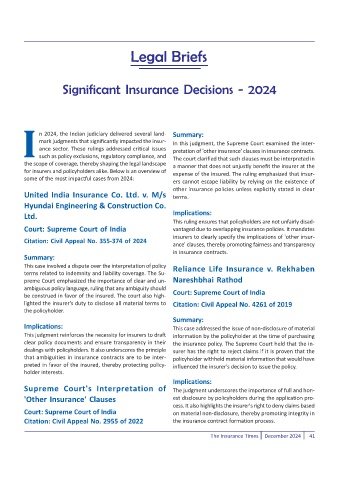

Legal Briefs

Significant Insurance Decisions - 2024

I n 2024, the Indian judiciary delivered several land- Summary:

mark judgments that significantly impacted the insur-

In this judgment, the Supreme Court examined the inter-

ance sector. These rulings addressed critical issues

pretation of 'other insurance' clauses in insurance contracts.

such as policy exclusions, regulatory compliance, and

the scope of coverage, thereby shaping the legal landscape The court clarified that such clauses must be interpreted in

a manner that does not unjustly benefit the insurer at the

for insurers and policyholders alike. Below is an overview of expense of the insured. The ruling emphasized that insur-

some of the most impactful cases from 2024:

ers cannot escape liability by relying on the existence of

other insurance policies unless explicitly stated in clear

United India Insurance Co. Ltd. v. M/s terms.

Hyundai Engineering & Construction Co.

Implications:

Ltd.

This ruling ensures that policyholders are not unfairly disad-

Court: Supreme Court of India vantaged due to overlapping insurance policies. It mandates

insurers to clearly specify the implications of 'other insur-

Citation: Civil Appeal No. 355-374 of 2024

ance' clauses, thereby promoting fairness and transparency

in insurance contracts.

Summary:

This case involved a dispute over the interpretation of policy Reliance Life Insurance v. Rekhaben

terms related to indemnity and liability coverage. The Su-

preme Court emphasized the importance of clear and un- Nareshbhai Rathod

ambiguous policy language, ruling that any ambiguity should

be construed in favor of the insured. The court also high- Court: Supreme Court of India

lighted the insurer's duty to disclose all material terms to Citation: Civil Appeal No. 4261 of 2019

the policyholder.

Summary:

Implications: This case addressed the issue of non-disclosure of material

This judgment reinforces the necessity for insurers to draft information by the policyholder at the time of purchasing

clear policy documents and ensure transparency in their the insurance policy. The Supreme Court held that the in-

dealings with policyholders. It also underscores the principle surer has the right to reject claims if it is proven that the

that ambiguities in insurance contracts are to be inter- policyholder withheld material information that would have

preted in favor of the insured, thereby protecting policy- influenced the insurer's decision to issue the policy.

holder interests.

Implications:

Supreme Court's Interpretation of The judgment underscores the importance of full and hon-

'Other Insurance' Clauses est disclosure by policyholders during the application pro-

cess. It also highlights the insurer's right to deny claims based

Court: Supreme Court of India on material non-disclosure, thereby promoting integrity in

Citation: Civil Appeal No. 2955 of 2022 the insurance contract formation process.

The Insurance Times December 2024 41